Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

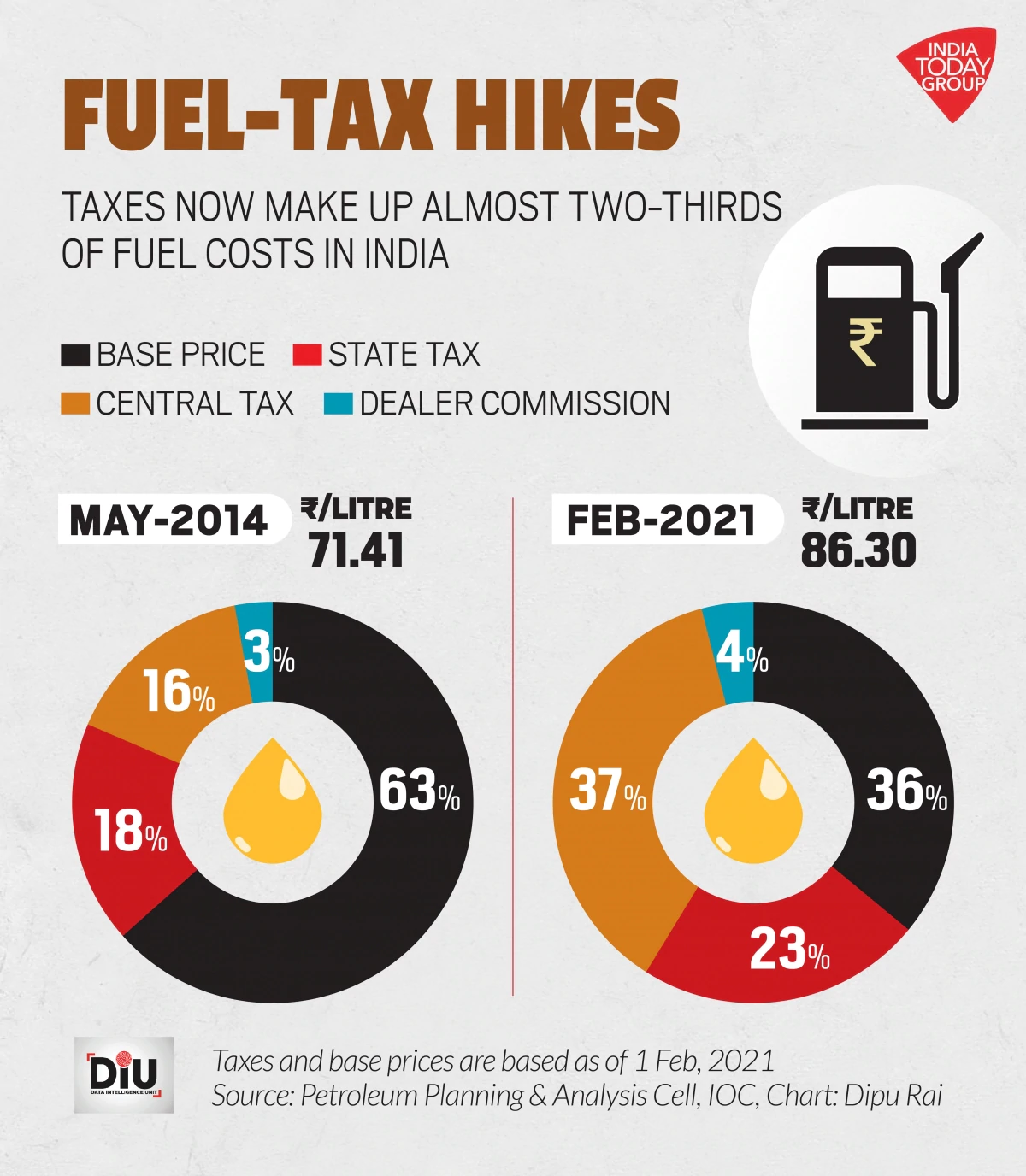

Taxes on Fuel

News: The disconnect between retail and wholesale inflation suggests that the two measures are driven by distinct and unrelated shocks.

Retail v/s Wholesale inflation

• In the months between April 2020 and November 2020, retail inflation remained above 6%, while average wholesale inflation was -0.20%.During the financial crisis (2008-2009) wholesale inflation came down significantly as commodity prices crashed after a boom, but retail inflation kept rising.

• This disconnect is reflected in the contemporaneous correlation between these two measures of inflation, which we find to be very low (0.04), and not significant.

• We cannot rule out feedback from wholesale inflation to retail inflation.To better explore this, it helps to understand the driving forces behind retail and wholesale inflation.

• Retail inflation is closely linked to food and beverage prices, partly because of their higher weightage in the consumer price index (CPI).High retail inflation in 2020 was primarily due to the rising prices of food and beverages.The surge was likely led by the usual supply shocks—rainfall, agricultural productivity, or Covid19-induced supply shocks.This suggests two important features of Indian retail inflation: it is predominantly led by supply shocks (food inflation shock) and it is transitory in nature.

• High wholesale inflation in recent months was mainly due to rising prices in fuel and power and manufacturing, which together comprise around 77% of the wholesale price index (WPI).Rising fuel and energy prices in India were a result of the recent increase in global oil prices.

Analysis:

• High wholesale inflation should not warrant any immediate policy responses as the two inflation measures seem to reflect different things.Overall, the high correlation between world energy inflation and India’s wholesale inflation (0.88) indicates that India’s wholesale inflation is predominantly driven by world commodity prices.

• On the other hand, the low correlation between India’s retail inflation and world energy inflation (-0.13, and not significant), suggests that India’s retail inflation is primarily driven by domestic food prices.

• Higher wholesale inflation implies a higher profit margin for producers, which acts as an incentive for investmentThere are, in fact, some early signs of a revival in investment in recent quarters, and policy must be careful not to derail this.

Wayforward:

• Given the pass-through of wholesale inflation into retail inflation, if the ongoing commodity boom persists, then the fuel and power component of the WPI is likely to raise retail inflation directly.

• At that point, there would be some urgency to increase the interest rate, which may be premature and could dampen the revival of growth prospects.

• To avoid the interest rate response, the best option going forward would be to rationalise fuel taxes, to reduce the pass-through of global commodity prices into wholesale prices and ultimately into retail inflation.

• The correct fiscal-monetary coordination requires fiscal policy not to be inflationary, so that the RBI can support growth by keeping interest rates low.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com