Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

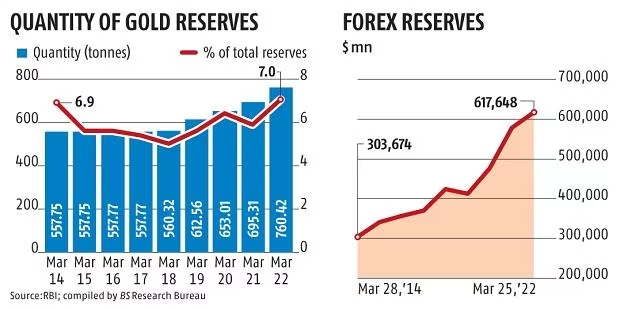

News: The RBI’s gold reserves touched 794.64 metric tonnes in fiscal 2023, an increase of nearly 5% over fiscal 2022.

→ The 794.64 tonnes of gold reserves included gold deposits of 56.32 tonnes.

→ 437.22 tonnes of gold is held overseas in safe custody with the Bank of England and the Bank of International Settlements (BIS).

→ 301.10 tonnes of gold is held domestically.

→ As on March 31 2023, India’s total foreign exchange (forex) reserves stood at $578.449 billion, and gold reserves were pegged at $45.2 billion.

→ Unlike fiat currencies, which can be subject to inflation or devaluation due to various economic factors, the value of gold tends to be relatively stable over time, which makes it an attractive asset for central banks to hold as a reserve.

→ Gold is highly liquid, which means it can easily be converted into cash or used to settle international transactions.

→ When the RBI has foreign currency (USD) in its reserves then it invests these dollars to purchase US Govt. bonds on which it earns interest. The real interest, however, on these bonds has turned negative due to the rise in inflation in the US. At the time of such inflation, the demand for gold has increased and RBI being its holder can earn a good return even in stressed economic situations.

→ Gold is safe, secure and more liquid asset and it performs better during times of crisis, and as a long-term store of value.

→ It serves as a hedge during geopolitical uncertainties – For example, the significance of Dollar in Global market is being challenged since Russia-Ukraine war. If RBI continues to hold dollars and it depreciates/weakens with respect to other currencies, then it's a loss for RBI. However, gold is able to retain its value much longer than other forms of currency.

→ Gold has an international price which is transparent, and it can be traded anytime.

→ According to the World Gold Council (WGC), gold is being bought mainly by central banks of emerging market economies.

→ During 2022, the central banks from the Middle East, including Egypt, Qatar, Iraq, the UAE, and Oman significantly boosted their gold reserves.

→ Also, several central banks, including the Monetary Authority of Singapore (MAS), the People’s Bank of China (PBoC) have been buying gold.

→ The two key drivers behind the decision to hold gold are i) its performance during crisis times and ii) its role as a long-term store of value.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com