Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Guidelines for Microfinance Institutions

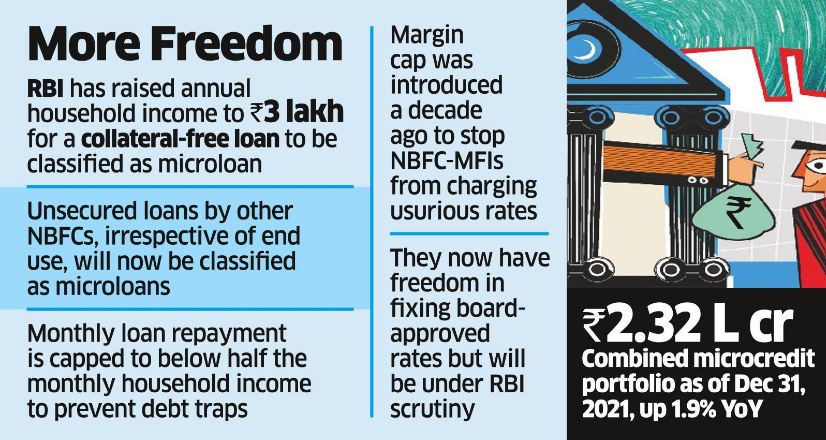

News: Recently, the Reserve Bank of India (RBI) allowed Microfinance Institutions(MFI) the freedom to set interest rates they charge borrowers, with a caveat that the rates should not be usurious.The guidelines will take effect 1st April 2022.Earlier in 2021, the RBI proposed to lift the interest rate cap on MFI.

Details:

• The RBI revised the definition of a microfinance loan to indicate a collateral-free loan given to a household having annual income of up to Rs. 3 lakh.Earlier, the upper limits were Rs.1.2 lakh for rural borrowers and Rs.2 lakh for urban borrowers.

• As per the revised norms, Regulated Entities (REs) should put in place a board-approved policy regarding pricing of microfinance loans, a ceiling on interest rate and all other charges applicable to microfinance loans.

• Each RE shall disclose pricing-related information to a prospective borrower in a standardised, simplified factsheet.

• There shall be no prepayment penalty on microfinance loans.Penalty, if any, for delayed payment shall be applied on the overdue amount and not on the entire loan amount.Any change in interest rate or any other charge shall be informed to the borrower well in advance and these changes shall be effective only prospectively.

• RE would have to put in place a mechanism for identification of the borrowers facing repayment-related difficulties, engagement with such borrowers and providing them necessary guidance about the recourse available.To ensure due notice and appropriate authorisation, the RE will provide the details of recovery agents to the borrower while initiating the process of recovery.

• Guidelines will be applicable for:

o All Commercial Banks (including Small Finance Banks, Local Area Banks, and Regional Rural Banks) excluding Payments Banks.

o All Primary (Urban) Co-operative Banks/ State Co-operative Banks/ District Central Co-operative Banks.

o All Non-Banking Financial Companies (including Microfinance Institutions and Housing Finance Companies).

Benefits:

• The revision of the income cap to Rs. 3 lakh will expand the market opportunity and interest rate cap removal will promote risk-based underwriting.

• It will go a long way in harmonising the regulatory framework for different types of lenders, encouraging healthy competition and enabling customers to make an informed choice regarding their credit needs.

• The new framework will help scale the industry further, ensure better risk mitigation and financial inclusion.

• It will create a level playing field and both borrowers and lenders will now have options.

• It will safeguard the interests of the borrowers and help the sector to cater to the needy borrowers.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com