Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

FPI’s exit and RBI acquires Gold

News: The Reserve Bank of India (RBI) added another 16.58 tonnes of gold to the country's foreign exchange reserves in the last six months, bringing the country's gold holdings to more than 700 tonnes (around 760.42).

• Gold was acquired by the RBI at a time when Foreign Portfolio Investors (FPIs) left India, and forex reserves dropped by USD44.73 billion from USD 642.45 billion in September 2021 to USD 597.72 billion on April 29, 2022.

• Now, India is the ninth-largest holder of gold reserves.

About FPI:

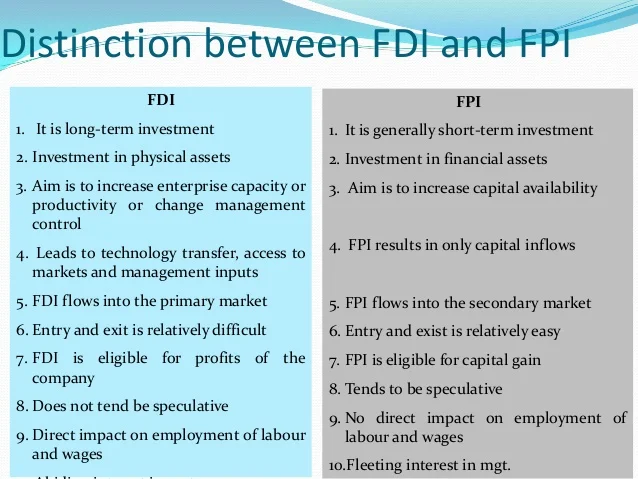

• Foreign portfolio investment (FPI) consists of securities and other financial assets passively held by foreign investors. It does not provide the investor with direct ownership of financial assets and is relatively liquid depending on the volatility of the market. Examples of FPIs include stocks, bonds, mutual funds, exchange traded funds, American Depositary Receipts (ADRs), and Global Depositary Receipts (GDRs).

• FPI is part of a country’s capital account and is shown on its Balance of Payments

• FPI is referred to as ‘hot money’ because of its tendency to flee at the first signs of trouble in an economy. FPI is more liquid, volatile and hence riskier than FDI.

Impact of FPI:

• Access to increased amount of Credit in Foreign countries

• Increases the liquidity of domestic capital markets. Increased liquidity in market ensures it becomes more profound and a comprehensive range of investments can be financed.

• Equity markets get stronger as increased competition for financing leads to rewarding superior performance, prospects and corporate governance.

Foreign Exchange Reserves:

• Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities. It needs to be noted that most foreign exchange reserves are held in US dollars.

• India’s Forex Reserve include Foreign Currency Assets, Gold Reserves, Special Drawing Rights and Reserve Tranche Position with the IMF.

What does rising Forex reserve imply?

• The rising forex reserves give comfort to the government and the RBI in managing India’s external and internal financial issues.

• The Forex reserves serves as a cushion during the event of BOP crisis. It limits the country against external vulnerability by maintaining foreign currency liquidity.

• It has helped the rupee strengthen against the dollar.

• Reserves will provide a level of confidence to markets and investors that a country can meet its external obligations.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com