Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

News: This is a method of restructuring debt which has grown popular in low-middle income countries in the past decade.

o It is a debt restructuring device between the creditor and a debtor by which the former forgoes a portion of the latter’s foreign debt/provides its debt relief, in return for a commitment to invest in specific environmental mitigation and adaptation projects.

o For example, to decarbonise the economy, develop climate-resilient infrastructure, or protect biodiverse forests or reefs. The utilisation of these swaps now stretches to finance enormous climate mitigation and adaptation projects.

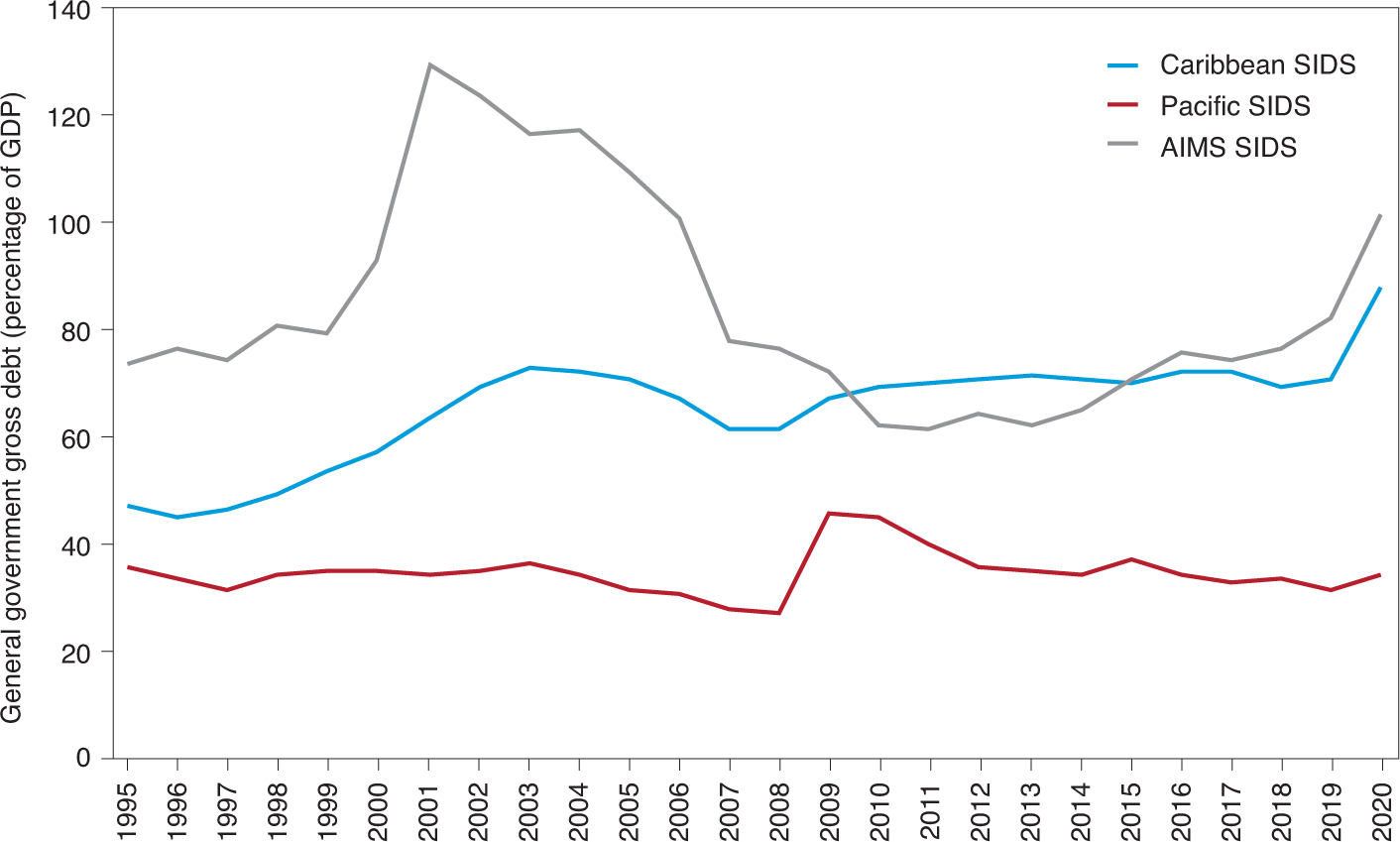

o Low and middle income nations are most vulnerable to perils of climate change. For example, Caribbean Small island development states - The COVID-19 pandemic resulted in a 73% drop in international tourist arrivals in 2020. Such nations can stand to benefit from such agreements.

o While being most vulnerable to climate change they are least able to afford the investment to strengthen resilience due to their debt burden.

o Debt-for-climate swaps are attractive instruments due to their transparency.

o Debt-for-climate swaps support climate investment by committing a country to swing their spending from debt service to an agreed public investment.

o Developed countries can fulfill their commitments by supporting developing countries through these instruments.

o In 2017, Seychelles announced the successful conclusion of negotiations for a debt-for-adaptation swap under a tripartite model. The Nature Conservancy (TNC), a US-based environmental organisation, bought $22 million of its debt in exchange for a promise to create 13 new marine protected areas.

o Swaps are mainly advantageous for small developing countries. However, the scaling up of the debt swap is still much lower than grants as creditors do not see their gain in this deal. Debt swaps can only be successful if the creditors are not rigid on returning the debt’s whole value.

Source – Down to Earth

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com