Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

World Energy Investment Report 2023

News: Investment in clean energy technologies is significantly outpacing spending on fossil fuels as affordability and security concerns triggered by the global energy crisis strengthen the momentum behind more sustainable options, according to a new IEA report.

Key Findings:

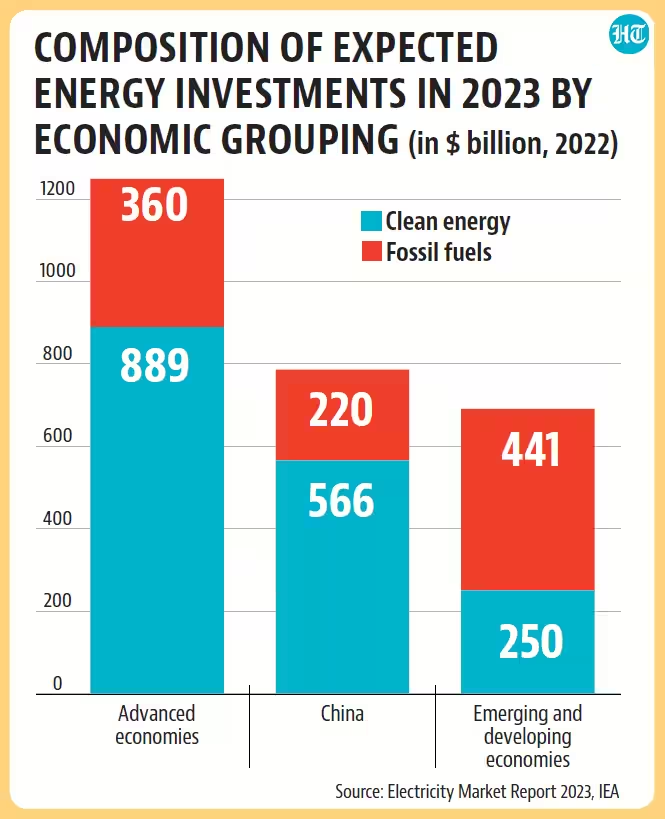

About USD 2.8 trillion is set to be invested globally in energy in 2023, of which more than USD 1.7 trillion is expected to go to clean technologies – renewables, EVs, grids, nuclear power, low emission fuels etc.

The remainder, slightly more than USD 1 trillion, is going to coal, gas and oil.

For every dollar spent on fossil fuels, $1.7 is now allocated to clean energy, a significant increase from the 1:1 ratio observed five years ago.

Annual clean energy investment is expected to rise by 24% between 2021 and 2023.

But more than 90% of this increase comes from advanced economies and China, presenting a serious risk of new dividing lines in global energy if clean energy transitions don’t pick up elsewhere.

The report also highlights the influence of recent geopolitical events on the energy market. It points out that Russia’s invasion of Ukraine has led to substantial instability in the fossil fuel markets. This volatility has inadvertently accelerated the deployment of various renewable energy technologies, despite triggering an immediate scramble for oil and gas resources.

What does the report mention of India and other developing economies?

The biggest shortfalls in clean energy investment are in emerging and developing economies. There are some bright spots, such as dynamic investments in solar in India and in renewables in Brazil and parts of the Middle East.

What are challenges faced by developing economies in transitioning to clean energy?

Investment in many countries is being held back by factors including higher interest rates, unclear policy frameworks and market designs, weak grid infrastructure, financially strained utilities, and a high cost of capital.

Much more needs to be done by the international community, especially to drive investment in lowerincome economies, where the private sector has been reluctant to venture.

Source – IEA website

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com