Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

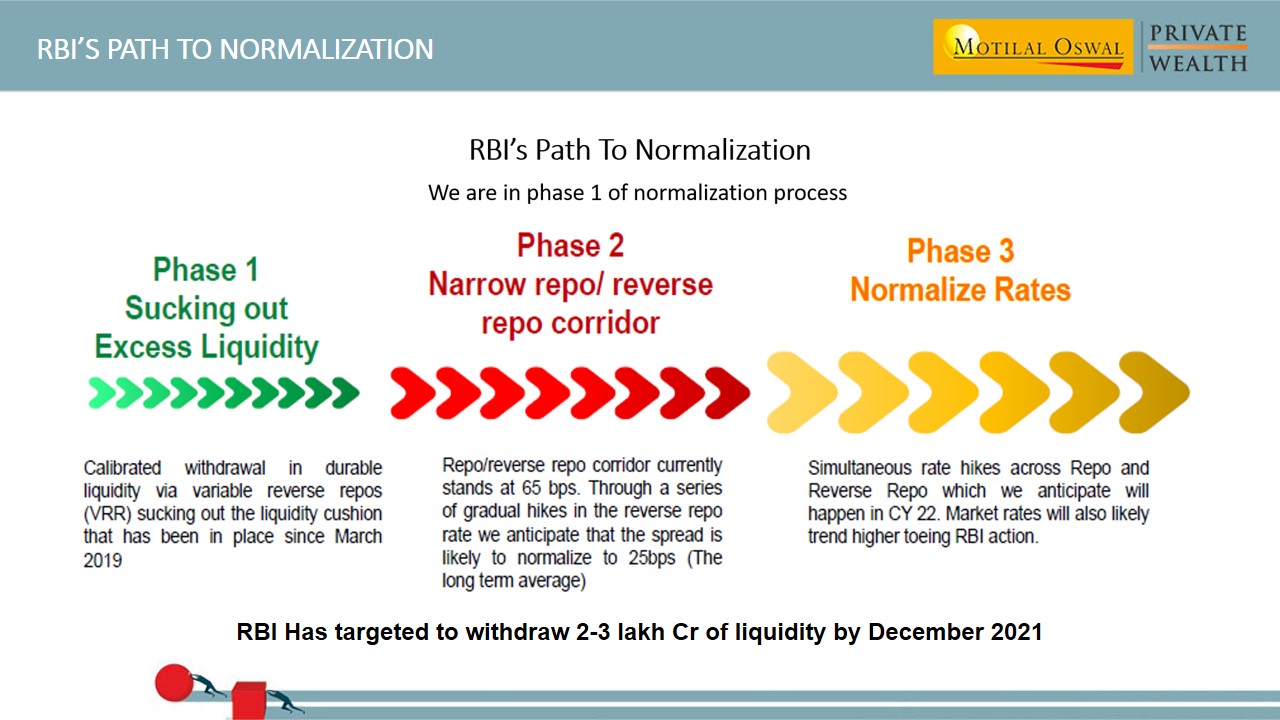

Variable reverse repo rate

News: The Reserve Bank of India (RBI) has said that it will conduct a three-day variable rate reverse repo (VRRR) auction for Rs 2 lakh crore.

What is Variable Reverse repo rate?

• VRRR is the rate at which the Reserve Bank of India (RBI) borrows money from banks for a variable period of time, usually ranging from 14 days to 56 days.

• It is one of the tools used by the RBI to manage liquidity in the banking system and to influence shortterm interest rates.

• The VRRR auction is conducted by the RBI on a regular basis to absorb excess liquidity from the banks.

• The banks can bid for the amount and the rate at which they are willing to lend money to the RBI. The RBI decides the cut-off rate and the amount based on the bids received.

• The banks that have placed their bids at or above the cut-off rate are allotted funds. The RBI pays interest to the banks for lending money to it. The interest rate is determined by the market forces of demand and supply of liquidity.

What are implications of VRRR auctions? (Important from Prelims perspective)

• Money market - The VRRR auction affects the overnight money market rates, such as call money, CBLO and market repo rates. These rates tend to move in tandem with the VRRR rates. As the VRRR rates increase, the money market rates also increase, reflecting tighter liquidity conditions.

• Bond market - The VRRR auction affects the bond yields, especially at the short end of the yield curve. As the VRRR rates increase, the bond yields also increase, reflecting higher borrowing costs and lower demand for bonds. This also affects the transmission of monetary policy signals to the bond market.

• Banking sector - The VRRR auction affects the profitability and liquidity management of banks. As the VRRR rates increase, banks earn higher returns on their excess funds parked with the RBI. However, this also reduces their availability of funds for lending and investment activities. Banks have to balance their liquidity needs and returns while participating in the VRRR auctions.

Are you a UPSC aspirant? Then DICS is the best IAS coaching institute in Ahmedabad, Gujarat. We offer top IAS/UPSC coaching in Ahmedabad at affordable fees. Both online and offline classes are available.

Prepare effectively for the GPSC exam by choosing the right institute.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com