Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Trends and Progress of Banking in India Report

News: As per the Reserve Bank of India’s (RBI) ‘Trend and Progress of Banking in India’ report, the Gross NonPerforming Assets (GNPA) ratio of Indian scheduled commercial banks (SCBs) consistently improved in the second quarter of FY24, reaching a decadal low.

What is Gross Non-Performing Assets (GNPA) ratio?

• The Gross Non-Performing Assets (GNPA) ratio is a financial metric used in the banking sector.

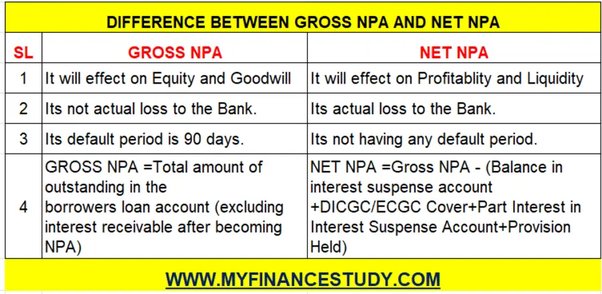

• Non-Performing Assets (NPA): The Reserve Bank of India defines Non-Performing Assets (NPA) as any advance or loan that is overdue for more than 90 days. An asset becomes non-performing when it ceases to generate income for the bank.

• Gross Non-Performing Assets (GNPA): GNPA stands for gross non-performing assets. GNPA is an absolute amount. It tells you the total value of gross non-performing assets for the bank in a particular quarter or financial year.

• GNPA Ratio: The GNPA ratio is calculated by dividing the total gross Non-Performing Assets by the total advances. This ratio gives an idea of how much of the total advances is not recoverable.

• Please note that a high GNPA ratio indicates a large proportion of a bank’s loans are not being repaid, which could impact the bank’s profitability and ability to lend. Conversely, a low GNPA ratio suggests that a larger proportion of a bank’s loans are being repaid.

Key Findings:

• The asset quality, reflected in GNPA ratios, improved from 2018-19 to 2022-23. The SCBs’ GNPA ratio dropped to 3.9% in March 2023 and further to 3.2% in September 2023, reaching a decade-low.

• Approximately 45% of the decline in SCBs’ GNPAs during 2022-23 resulted from recoveries and upgradations.

• In 2022-23, the consolidated balance sheet of SCBs (excluding Regional Rural Banks) saw a 12.2% growth, the highest in nine years. The primary factor behind this expansion on the asset side was bank credit, which experienced its fastest pace of growth in over a decade.

• In 2022-23, non-banking financial companies (NBFCs) saw a 14.8% expansion in their consolidated balance sheet, driven by double-digit credit growth.

• The RBI stressed that qualitative metrics like improved disclosures, robust code of conduct, and transparent governance structures contribute to financial stability.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com