Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

The issue of Evergreening Loans in India

Context: The Reserve Bank of India (RBI) has raised concerns over loan evergreening, citing the potential negative impact on the banking sector and the economy.

What is Evergreening of Loans?

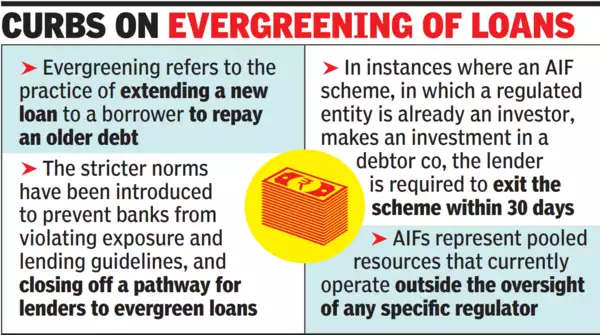

• Evergreening of Loans is a practice where banks extend new or additional loans to a borrower who is unable to repay the existing loans. This is done to revive a loan that is on the verge of default.

• The aim is to prevent these loans from being classified as Non-Performing Assets (NPAs) or bad loans.

Key Findings by RBI:

• Banks were found using innovative ways to hide stressed loans. For example, a sale and buyback arrangements between two banks to reset the history of a stressed loan, and some banks were found extending loans to entities related to already stressed borrowers, using this to hide the actual stressed nature of the original loans.

• Some banks invested in Alternate Investment Funds which would bail out stressed entities, contributing tacitly to continue cycle of evergreening.

• Mutual funds heavily invested in Commercial Papers (CP) issued by banks, which offered higher returns than government securities. Banks eventually used CP proceeds for short-term funding, contributing to indirect evergreening.

What are the implications of evergreening loans in India?

• False Impression of Asset Quality and Profitability

• Delay in Recognition and Resolution of Stressed Assets

• Undermining Credit Discipline and Moral Hazard

• Erosion of Trust and Confidence of depositors, investors, and regulators

• Increased Systemic Risks

What measures have been introduced to curb and monitor the practice of evergreening of loans by Banks?

• Tightening Norms for Investments in AIFs: The RBI has tightened norms for lenders relating to making investments in units of Alternative Investment Funds (AIFs) to address concerns relating to possible evergreening of stressed loans.

• Liquidation Time: In case lenders have investments that could lead to evergreening, they have 30 days to liquidate them. If lenders are not able to liquidate their investments within this time limit, they have to make 100 percent provision on such investments.

• Asset Quality Review: The RBI initiated an asset quality review in 2015 after observing rampant evergreening of loans3 This review was aimed at identifying stressed assets in banks’ books and taking corrective measures.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com