Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

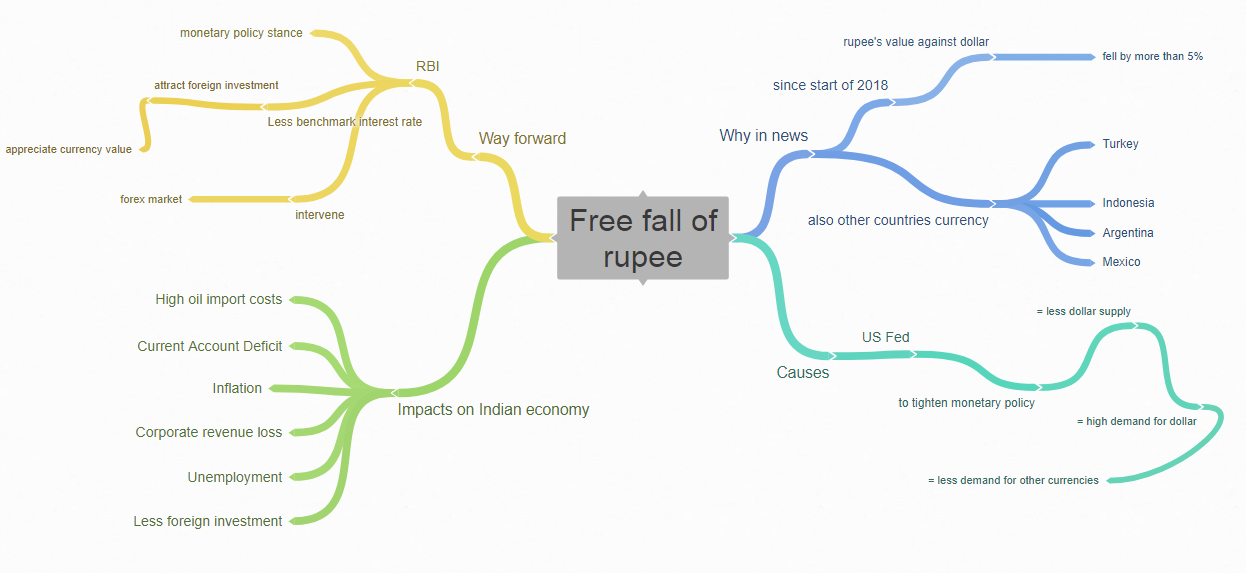

The Free Fall of Indian Rupee

News: The Indian rupee hit an all-time low against the US dollar this week weakening past the 79 rupees to a dollar mark and selling as low as 79.05 against the dollar. Many analysts expect the rupee to weaken further in the coming months and move past the 80 rupees to dollar mark.

What is Currency Depreciation?

• Currency depreciation is a fall in the value of a currency in a floating exchange rate system.

• Rupee depreciation means that the rupee has become less valuable with respect to the dollar.

• It means that the rupee is now weaker than what it used to be earlier.

• For example, USD 1 used to equal to Rupees 70, now USD 1 is equal to Rupees 79, implying that the rupee has depreciated relative to the dollar. In other words, it takes more rupees to purchase a dollar.

How is Depreciation of Rupee a double edged sword for the RBI?

Positive:

• Weaker rupee should theoretically give a boost to India’s exports, but in an environment of uncertainty and weak global demand, a fall in the external value of rupee may not translate into higher exports.

Negative:

• It poses risk of imported inflation, and may make it difficult for the central bank to maintain interest rates at a record low for longer.

• India meets more than two-thirds of its domestic oil requirements through imports.

• India is also one of the top importers of edible oils. A weaker currency will further escalate imported edible oil prices and lead to a higher food inflation.

How do we determine value of Rupee?

• The value of any currency is determined by demand for the currency as well as its supply. When the supply of a currency increases, its value drops.

• In the wider economy, central banks determine the supply of currencies, while the demand for currencies depends on the amount of goods and services produced in the economy.

• In the forex market, the supply of rupee is determined by the demand for imports and various foreign assets. So, if there is high demand to import oil, it can lead to an increase in the supply of rupees in the forex market and cause the rupee’s value to drop.

• The demand for rupees in the forex market, on the other hand, depends on foreign demand for Indian exports and other domestic assets.

• When there is great enthusiasm among foreign investors to invest in India, it can lead to an increase in the supply of dollars in the forex market which in turn causes the rupee’s value to rise against the dollar.

Why is the Rupee losing its value against the dollar?

• The U.S. Federal Reserve has been raising its benchmark interest rate causing investors seeking higher returns to pull capital away from emerging markets such as India and back into the United States. This, in turn, has put pressure on emerging market currencies which have depreciated significantly against the U.S. dollar so far this year.

• Some analysts believe that the RBI’s surprise decision to raise rates in May could have simply been to defend the rupee by preventing any rapid outflow of capital from India.

• India’s current account deficit, which measures the gap between the value of imports and exports of goods and services, is expected to hit a 10 year high of 3.3% of gross domestic product in the current financial year.

• Foreign investors are unlikely to plough capital into India when investment yields are rising in the U.S.

• Consistently higher domestic price inflation in India. Higher inflation in India suggests that the RBI has been creating rupees at a faster rate than the U.S. Federal Reserve has been creating dollars.

Way Forward:

• Analysts believe that, over the long run, the rupee is likely to continue to depreciate against the dollar given the significant differences in long run inflation between India and the U.S.

• At the moment, as the U.S. Federal Reserve raises rates to tackle historically high inflation in the country, other countries and emerging markets in particular will be forced to raise their own interest rates to avoid disruptive capital outflows and to protect their currencies.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com