Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

State Finances: A study of Budgets of 2022-23

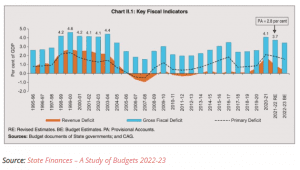

News: Recently, the Reserve Bank of India (RBI) has released a report stating that the Gross Fiscal Deficit (GFD) of states is expected to decrease to 3.4% of Gross Domestic Product (GDP) in 2022-23, from 4.1% in 2020-21.

What is Gross Fiscal Deficit?

• GFD measures the overall financial health of the state government and is calculated by subtracting total revenue from total expenditure.

• A decrease in GFD is generally considered a positive sign as it indicates that the state government is able to balance its revenue and expenditure more effectively.

Key Findings:

• The report titled 'State Finances: A Study of Budgets of 2022-23' is a comprehensive analysis of the financial position of the Indian states, including the trends and challenges in their revenue and expenditure.

• According to the RBI report, states' debt is expected to decrease to 29.5% of GDP in 2022-23, compared to 31.1% in 2020-21.

• However, the report also highlights that this is still higher than the 20% recommended by the Fiscal Responsibility and Budget Management (FRBM) Review Committee in 2018.

• States are anticipating an increase in non-tax revenue, which is generated from sources such as fees, fines, and royalties. This increase is likely to be driven by revenue from industries and general services.

• The report notes that states are expecting to see an increase in revenue from various sources such as State GST, excise taxes, and sales taxes in the 2022-2023 fiscal year.

Key measures suggested by RBI:

• Debt consolidation should be a priority for state governments.

• Allocating more resources to key sectors such as healthcare, education, infrastructure, and green energy, the states can promote economic growth and development.

• Create favorable environment for private sector to invest in the states.

• States also need to encourage and facilitate higher inter-state trade and commerce to realize the full benefit of spillover effects of state capex across the country.

• The report is proposing that it would be beneficial to establish a fund that would be used to buffer capital expenditure during periods of strong revenue growth. The purpose of this fund would be to maintain a consistent level of spending on capital projects, and to ensure that spending on these projects is not drastically reduced during economic downturns.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com