Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

RoDTEP Scheme

News: The U.S. and the European Union have now imposed countervailing duties (CVDs) on four Indian products, as a retaliation against the Remission of Duties and Taxes on Export Products (RoDTEP) scheme introduced for outbound shipments in January 2021.

Background of the issue:

• Countervailing investigations conducted by the U.S. and the European Commission (EC) have led to final determinations of Countervailing Duties (CVD) on various products.

• Products affected include paper file folders, common alloy aluminum sheet, forged steel fluid end blocks (by the U.S.), and certain graphite electrode systems (by the EC).

• The Indian government and impacted exporters vigorously defended subsidy allegations related to government programs at both Central and State levels. It involved strong written and oral responses were presented during the investigation processes.

About CVD:

• Countervailing Duty (CVD) is a tariff or tax levied on imported goods to offset subsidies given by the exporting country’s government. It’s an import tax imposed by the importing country on imported products when such products enjoy benefits like export subsidies and tax concessions in the country of their origin.

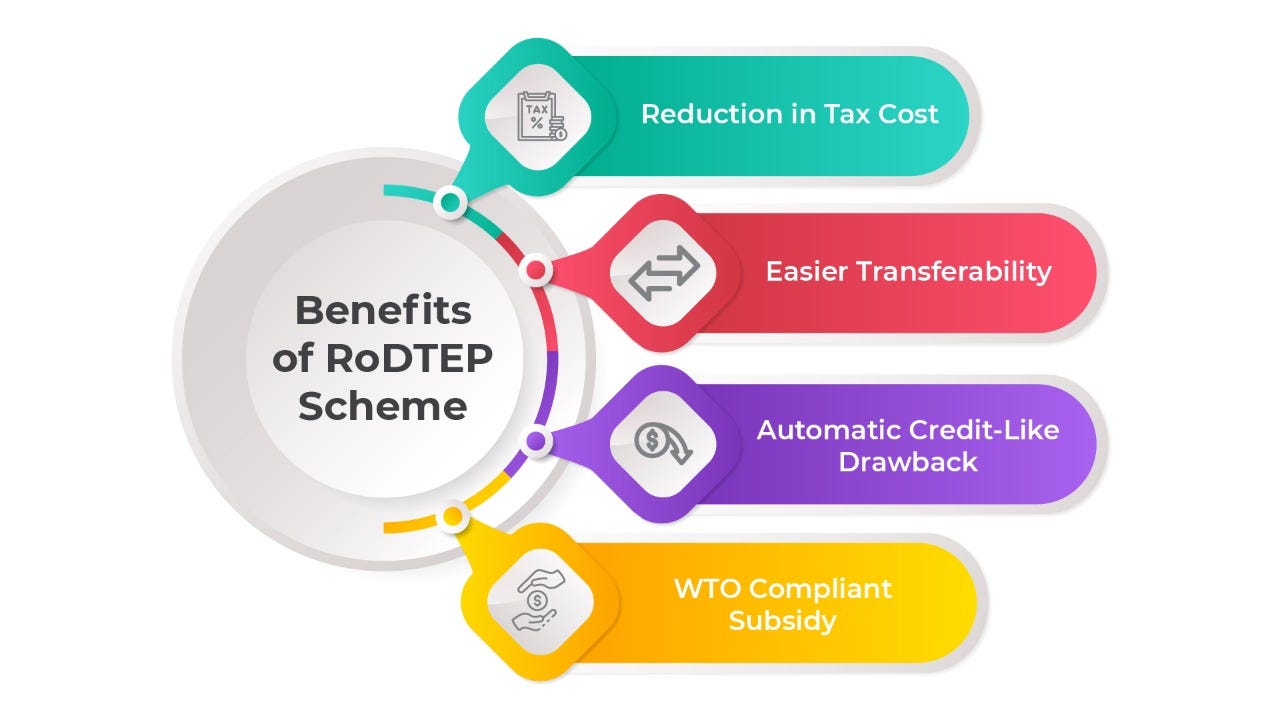

What is RoDTEP scheme?

• The RoDTEP scheme is an initiative by the Commerce Ministry of India. It was introduced to replace the existing MEIS (Merchandise Exports from India Scheme) and became applicable from January 1, 2021.

• The scheme aims to boost exports by ensuring that exporters receive refunds on the embedded taxes and duties that were previously non-recoverable.

Key features:

• Refund of Non-refundable Duties and Taxes: Taxes such as Mandi tax, VAT, Coal cess, Central Excise duty on fuel, etc., which were previously non-refundable, will now be refunded under this scheme.

• Automated System of Credit: The refund will be issued in the form of transferable electronic scrips. These duty credits will be maintained and tracked through an electronic ledger.

• Quick Verification through Digitization: The digital platform ensures faster clearance. Verification of the records of the exporters will be done with the help of an IT-based risk management system.

• Multi-sector Scheme: All sectors, including the textiles sector, are covered under RoDTEP to ensure uniformity across all areas.

Impact on Indian Exports:

• Increased Competitiveness: The scheme ensures that exporters receive refunds on the embedded taxes and duties that were previously nonrecoverable. This leads to cost competitiveness of exported products in international markets

and better employment opportunities in export-oriented manufacturing industries.

• Focus on Potential Sectors: The government’s focus has been on products that are relatively poor in export volume and have good potential to penetrate the international market.

• Level Playing Field: RoDTEP is going to give a boost to Indian exports by providing a level playing field to domestic industry abroad.

• WTO Compliance: The scheme ensures that India stays WTO-compliant

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com