Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

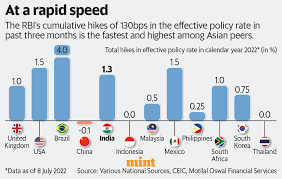

RBI’s recent rate hikes

News: A 50 bps rate hike has become ‘new normal’ for central banks, says Shaktikanta Das.

About:

• With the latest hike from the six-member Monetary Policy Committee (MPC), the repo rate now stands at 5.4 per cent.

• Repo is the rate at which the central bank lends short-term funds to banks. Changes in this rate typically gets transmitted to the broader banking system.

• This is set to increase lending rates and EMIs of existing home loan customers.

• While the RBI Governor maintained a GDP growth of 7.2 per cent for FY23, inflation has been projected at 6.7 per cent for the year 2022-23.

Reasons behind recent rate hikes:

• With inflation expected to remain above elevated levels, the MPC felt further calibrated withdrawal of monetary policy accommodation and accordingly it decided to increase repo rate by 50 basis point. Calibrated accommodation is to keep inflation within the target along with supporting growth.

• CPI has eased from its surge in April but remains uncomfortably high and above the target of 6 percent.

• Core inflation remains at elevated levels and the volatility in global markets is impinging on domestic markets including currency.

What are the external factors that will continue to impact India?

• The inflation trajectory will depend upon global markets and geopolitical developments. There has been some let up in commodity prices and softening in global food prices.

• While household inflation expectation has eased, it remains at elevated levels. If the monsoon is normal, and at an average crude oil price of $105 per barrel for the year, inflation is projected at 6.7 per cent in 2022-23.

• The International Monetary Fund has highlighted recession risk and revised global growth, for emerging market economies the risks are magnified as they have domestic inflation concerns and there will be impact of monetary tightening worldwide.

• Continued volatility of external markets is also likely to impact India as it always does.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com