Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

RBI hikes Repo Rate yet again

News: The Monetary Policy Committee (MPC) of the Reserve Bank of India on Wednesday hiked the key policy rate, the Repo rate or the rate at which the RBI lends funds to banks, by 25 basis points to 6.50 per cent in a bid to rein in retail inflation.

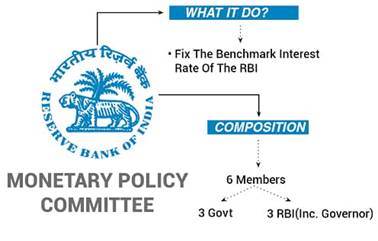

What is the MPC?

Section 45ZB of the amended RBI Act, 1934 provides for an empowered six-member monetary policy committee (MPC) to be constituted by the Central Government by notification in the Official Gazette. The first such MPC was constituted on September 29, 2016.

Governor of RBI is the ex-officio chairperson of MPC.

The MPC determines the policy repo rate required to achieve the inflation target.

The MPC is required to meet at least four times in a year. The quorum for the meeting of the MPC is four members.

Each member of the MPC has one vote, and in the event of an equality of votes, the Governor has a second or casting vote.

Each Member of the Monetary Policy Committee writes a statement specifying the reasons for voting in favour of, or against the proposed resolution.

What will be the impact of recent hikes?

Lending rates of banks are expected to go up as the cost of funds is expected to rise further.

EMIs on vehicles, home and personal loans will also rise.

The external benchmark linked lending rate (EBLR) of banks will rise by 25 bps — one basis point is onehundredth of a percentage point— as such loans are linked to the Repo rate.

As much as 43.6 per cent of the total loans are now linked to the Repo rate.

Marginal cost of funds-based lending rates (MCLR), which accounts for 49.2 per cent of the loans portfolio of banks, are also expected to move up. The hike will help in moderating inflation in the country.

Deposit rates are also expected to witness some realignment.

Key Highlights about Forecasts:

The RBI has projected GDP growth for the next fiscal (FY2024) at 6.4 per cent.

The central bank has lowered the inflation target for FY23 from 6.7 per cent to 6.5 per cent – which is still above the RBI’s comfort level of four per cent. Inflation is expected to be 5.3 per cent in FY24.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com