Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

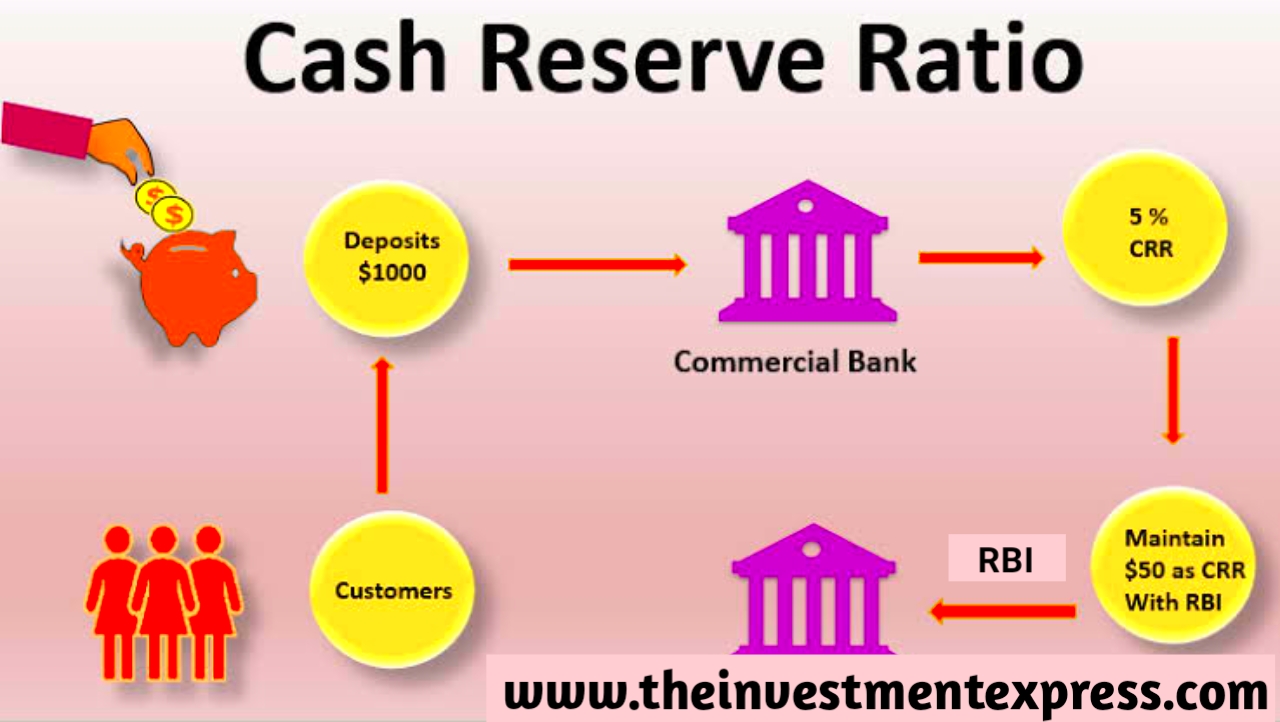

RBI hikes Repo Rate and Cash Reserve Ratio

News: The Reserve Bank of India’s Monetary Policy Committee (MPC) has increased the policy Repo Rate by 40 basis points to 4.40%, with immediate effect and Cash Reserve Ratio (CRR) of banks by 50 basis points to 4.5% of Net Demand and Time Liabilities (NDTL).

Reasons behind the hike?

• Globally, there has been a sharp rise in inflation due to current geopolitical tensions. Inflation has risen to its highest level in the last 3-4 decades in major economies with global crude oil prices remaining volatile and above USD 100 per barrel.

• The hike in Repo rate and CRR is aimed at reining in elevated inflation amid the global turbulence in the wake of the Ukraine war.

• The RBI aimed to keep inflation which is already close to 7% at its desired level and control and monitor money flow into the banking system.

• There has also been a spike in fertiliser prices and other input costs, which has a direct impact on food prices in India.

• There was a spike in the headline CPI (Consumer Price Inflation) inflation to 6.95% in March 2022.

How does hike in Repo Rate impact you?

• It is expected to push up interest rates in the banking system. Equated Monthly Installments (EMIs) on home, vehicle and other personal and corporate loans are likely to go up.

• Deposit rate, mainly fixed term rates, are also set to rise.

• Consumption and demand are impacted by Repo rate hike. For example, knowing that Home Loans, Car loans will get costlier. The customers postpone their demand with an intention to buy it later at a reduced cost.

How does hike in CRR impact Banks?

• The hike will suck out Rs 87,000 crore from the banking system. Thus, lendable resources of banks will come down.

• It also subsequently results in increased cost of funds and banks net interest margins could get adversely impacted.

• Net interest margin (NIM) is a measure of the difference between the interest income earned by a bank or other financial institution and the interest it pays out to its lenders (for example, depositors), relative to the amount of their assets that earn interest.

What is the Monetary Policy Committee?

• It is a statutory and institutionalized framework under the Reserve Bank of India Act, 1934, for maintaining price stability, while keeping in mind the objective of growth.

• The Governor of RBI is ex-officio Chairman of the committee.

• The MPC determines the policy interest rate (repo rate) required to achieve the inflation target (4%).

• An RBI-appointed committee led by the then deputy governor Urjit Patel in 2014 recommended the establishment of the Monetary Policy Committee.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com