Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Prompt Corrective Action (PCA) Framework

News: Recently, The RBI has announced the extension of the PCA framework to Government Non-Banking Financial Companies (NBFCs), excluding those in the Base Layer, starting from October 1, 2024.

Which NBFC’s will come under PCA framework?

• Power Finance corporation, Rural Electrification Corporation Limited, ndian Railway Finance Corporation, Industrial Finance Corporation of India.

What is the PCA framework?

• The Prompt Corrective Action (PCA) Framework is a mechanism introduced by the Reserve Bank of India which is designed to monitor banks with weak financial metrics and intervene early to restore their financial health.

• The framework is applied to banks that become undercapitalized due to poor asset quality or become vulnerable due to loss of profitability.

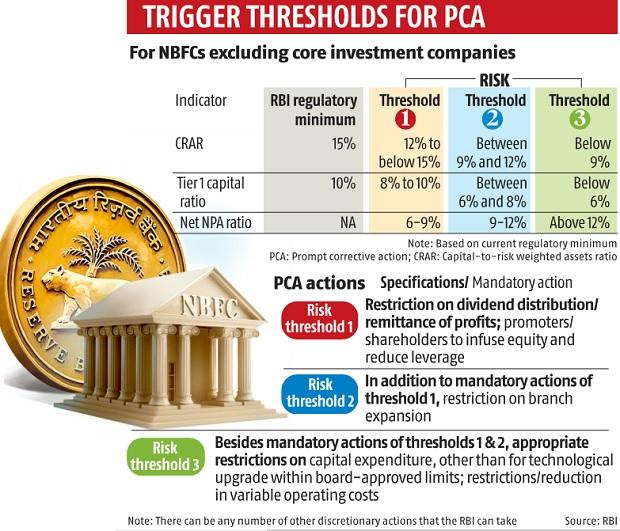

• The PCA Framework focuses on three key areas - Capital, Asset Quality, and Leverage.

• The indicators tracked for these areas are the CRAR/Common Equity Tier I Ratio, Net NPA Ratio, and Tier I Leverage Ratio respectively. A breach of any risk threshold may result in the invocation of PCA.

Objectives of PCA framework

• The objective of the PCA Framework is to enable supervisory intervention at appropriate time and require the supervised entity to initiate and implement remedial measures in a timely manner, so as to restore its financial health.

• Effective tool to ensure market discipline.

What are the reasons for expanding PCA framework to govt. owned NBFC’s?

• The NBFCs have been growing in size and have substantial interconnectedness with other segments of the financial system.

• In 2022, the RBI introduced the PCA framework for NBFCs to strengthen supervisory tools. The objective is to facilitate timely supervisory intervention and mandate corrective actions to restore financial health.

• The framework serves as a mechanism for effective market discipline, ensuring that NBFCs adhere to financial prudence

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com