Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

OXFAM inequality report

News: The article is based on the article “Oxfam inequality report - Taxing the ‘obscenely’ wealthy may not be the right solution”. It explains the Oxfam “Survival of Richest report” and analyses its claims regarding the tax structure in India.

Key Findings of OXFAM “Survival of Richest Report”

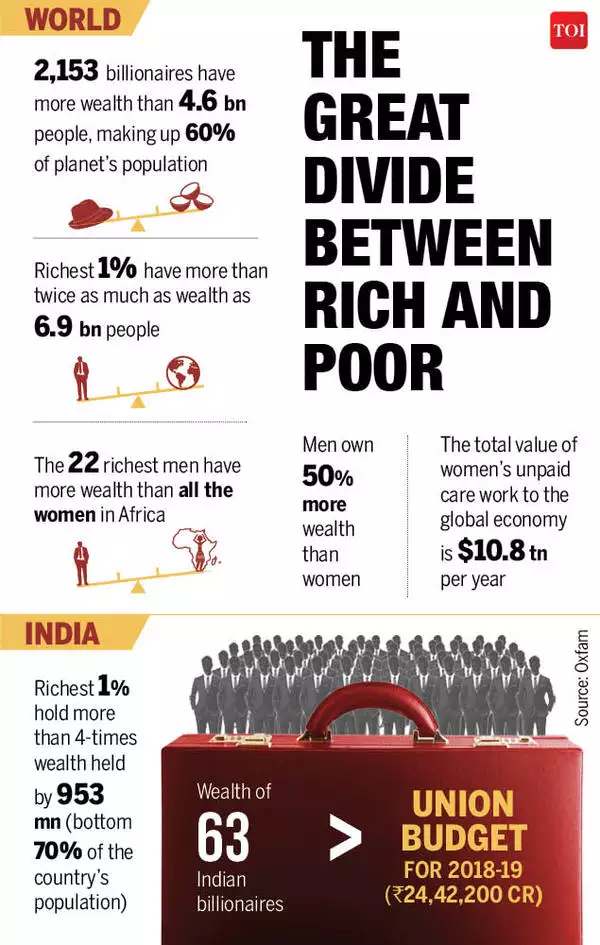

• According to the report, there are now 166 billionaires in India. It is up from 106 in 2020. Wealth is concentrated among the top deciles. Top 30% accounts for 90% of the wealth.

• Globally, 1% are estimated to have captured almost two-thirds of new wealth.

• It argues for a wealth tax and higher taxes on corporates.

• It also argues that indirect taxes are regressive. The paper says that the bottom 50% pays six times more indirect tax as a percentage of income as compared to the top 10%.

Implications of these findings:

• It can stir the debate for an equalizing wealth tax (a progressive wealth tax where the tax rate increases as the wealth of an individual increase. The goal is to redistribute wealth and reduce inequality among citizens.)

• Oxfam argues that indirect taxes are regressive and suggests –

o A wealth tax – a tax on unrealized capital gains and higher taxes on corporates.

o Tax on incomes, capital gains and wealth are interrelated and the changes cannot be recommended in isolation.

• Tax collection depends upon The mix of taxes that a country raises as a function of its institutional capacity, the structure of the tax base and the desire for simplification.

What does the report say in context of India?

• The lower corporate tax rate in lieu of incentives and the introduction of GST – a costly experiment of tax policy in India.

• The corporate tax cuts brought the statutory tax rate down from 30 to 25.17%, leading to a revenue loss of Rs 1.03 lakh crore.

• Oxfam uses NSS 2011-12 to establish that the bottom 50% pays six times more indirect tax as compared to the top 10%.

• The current income tax system exempts incomes up to Rs 5 lakh from tax and the GST rate structure places a higher burden on luxuries.

What are issues with OXFAM report?

• The report is spot on as far as mentioning about rising inequalities is concerned and need for tax reform. However, its assumptions are inaccurate as seen in India’s previous experience.

• For example, it says India will gain 10% more in taxes than it currently collects indirect taxes from the introduction of the wealth tax.

• A wealth tax has historically been utilized by nations, including India, but the revenues were dismal, making it an expensive tax to operate. Hence, a compartmentalized approach to tax policy that links several taxes that are levied against the same base is meaningless.

Way forward

• Everything is not fixed by taxes. The role of other macroeconomic policies, like low interest rates and regulatory interventions, should not be ignored.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com