Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

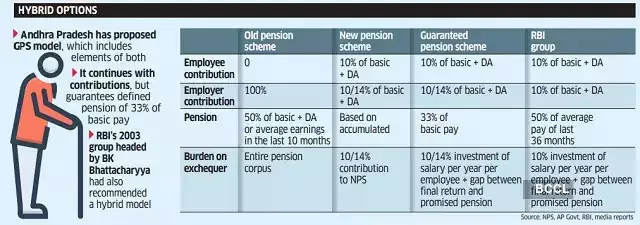

OPS vs NPS

News: The debate surrounding Old pension scheme vs National Pension Scheme (popularly called as New pension scheme) is a contested topic in the country. Several states (Rajasthan, Punjab, Chattisgarh) have announced to revert to OPS.

What is Old Pension Scheme?

• The Old Pension Scheme(OPS) is applicable to all government employees appointed before January 1, 2004. The scheme is a “defined benefit scheme” as the government employees were paid 50% of their last drawn salary plus Dearness Allowance (DA) as pension after their retirement.

• Under the OPS, the government pays the entire pension amount to government employees after retirement. Thus, no amount is deducted from employees’ salaries when they are in service.

What is the National Pension Scheme?

• In 2004, the National Democratic Alliance (NDA) government discontinued the OPS and introduced the National Pension Scheme (NPS) for government employees. The NPS was extended to all citizens, including self-employed and unorganised workers, in 2009.

• The scheme is a “defined contribution scheme” as the government employees have to make defined contribution of 10% of basic pay and dearness allowance (DA). There is matching contribution by the government. There is no defined benefit.

• The pension benefit is determined by factors such as the amount of contribution made, the age of joining, the type of investment and the income drawn from that investment.

Why was the NPS introduced?

• Heavy Fiscal burden on the central and state government due to OPS as with every new pay commission awards the basic pay of government employees was increasing.

• The OPS scheme used to disincentivise early retirement as the pension was fixed at 50% of the last drawn salary. Many government employees would hang onto their jobs in hope of better pension.

• NPS offers flexibility to the subscriber to choose the fund manager and the preferred investment option including a 100% government bond option. A guaranteed return option could also be considered to provide an assured annuity.

• The OPS covered only the government employees which formed 12% of total workforce of the country while NPS is open to even workers from unorganized sector.

Issues with NPS

• Concerns surrounding Market volatility worries employees who feel the scheme may not derive same benefits as OPS

• Fewer disposable income in the hands of employees as compared to OPS

• Under the OPS, fixed returns were guaranteed for employee contribution to the General Provident Fund (GPF). However, NPS has no General Provident Fund (GPF) provisions.

What are concerns behind shifting to OPS?

• OPS is unsustainable because the liability of pension will keep on increasing every year due to the increase in dearness allowances (DA) and increase in life expectancy rates.

• State governments are spending 1/4th of their revenues only on pensions. It will further increase the debts of the states.

• The current generation of taxpayers is already facing the burden of paying for the pensions of OPS employees and the government contributions newer employees under NPS. Returning back to OPS will further increase the burden on the taxpayers.

• No provisions for separate corpus for funding the pension liability.

Way Forward

• Design an “Assured pension Scheme” by linking it to minimum level of pay and not the last drawn salary as provided under OPS.

• There is need to empower citizens regarding Financial literacy as well. Education about spending patterns, different investment avenues, financial planning and retirement planning is equally important.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com