Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Oil Bonds

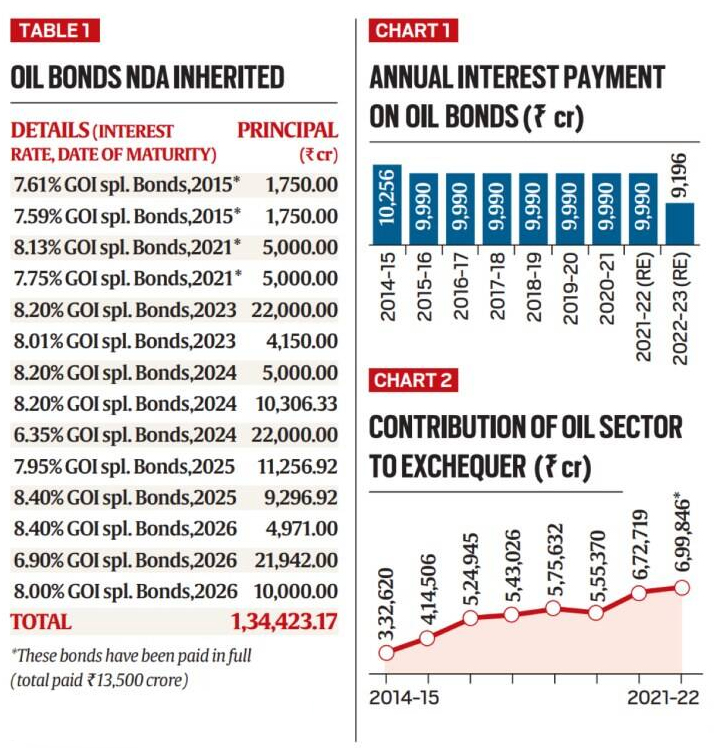

News: Recently, the Finance Minister has countered criticism of high oil prices by claiming that the government cannot bring down taxes - and thus oil prices because it has to pay for oil bonds issued by the Previous Government.

About:

• An oil bond is an IOU, or a promissory note issued by the government to the OMCs, in lieu of cash that the government would have given them so that these companies don’t charge the public the full price of fuel. An IOU which stands for “I owe you”, is a document that acknowledges existence of debt.

• An oil bond says the government will pay the oil marketing company the sum of, say, Rs 1,000 crore in 10 years.

• And to compensate the OMC for not having this money straightaway, the government will pay it, say, 8% (or Rs 80 crore) each year until the bond matures.

• Thus, by issuing such oil bonds, the government of the day is able to protect/ subsidize the consumers without either ruining the profitability of the OMC or running a huge budget deficit itself.

Why were they issued?

• When fuel prices were too high for domestic consumers, governments in the past often asked Oil Marketing Companies (OMCs) to avoid charging consumers the full price.

• But if oil companies don’t get paid, they would become unprofitable. To address this, the government said it would pay the difference.

• If the government paid that amount in cash, it would have been pointless, because then the government would have had to tax the same people to collect the money to pay the OMCs. This is where oil bonds come in.

Is it right to issue such bonds?

• Former PM Manmohan Singh was correct in noting that issuing bonds just pushed the liability to a future generation. But to a great extent, most of the government’s borrowing is in the form of bonds. This is the reason why Fiscal Deficit is so keenly tracked.

• In a country like India, all governments are forced to resort to the use of bonds of some kind.

• The current NDA government itself, which has issued bonds worth Rs 2.79 lakh crore (twice the amount of oil bonds) to recapitalise public sector banks.

How much tax is charged on fuel prices?

• There are two components to the domestic retail price — the price of crude oil itself, and the taxes levied on this basic price.

• Together they make up the retail price.

• The taxes vary from one product to another. For instance, as of now, taxes account for 50% of the total retail price for a litre of petrol, and 44% for a litre of diesel.

However, critics claim that what the government has had to pay for oil bonds, the payout is not big compared to revenues earned in this sector.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com