Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

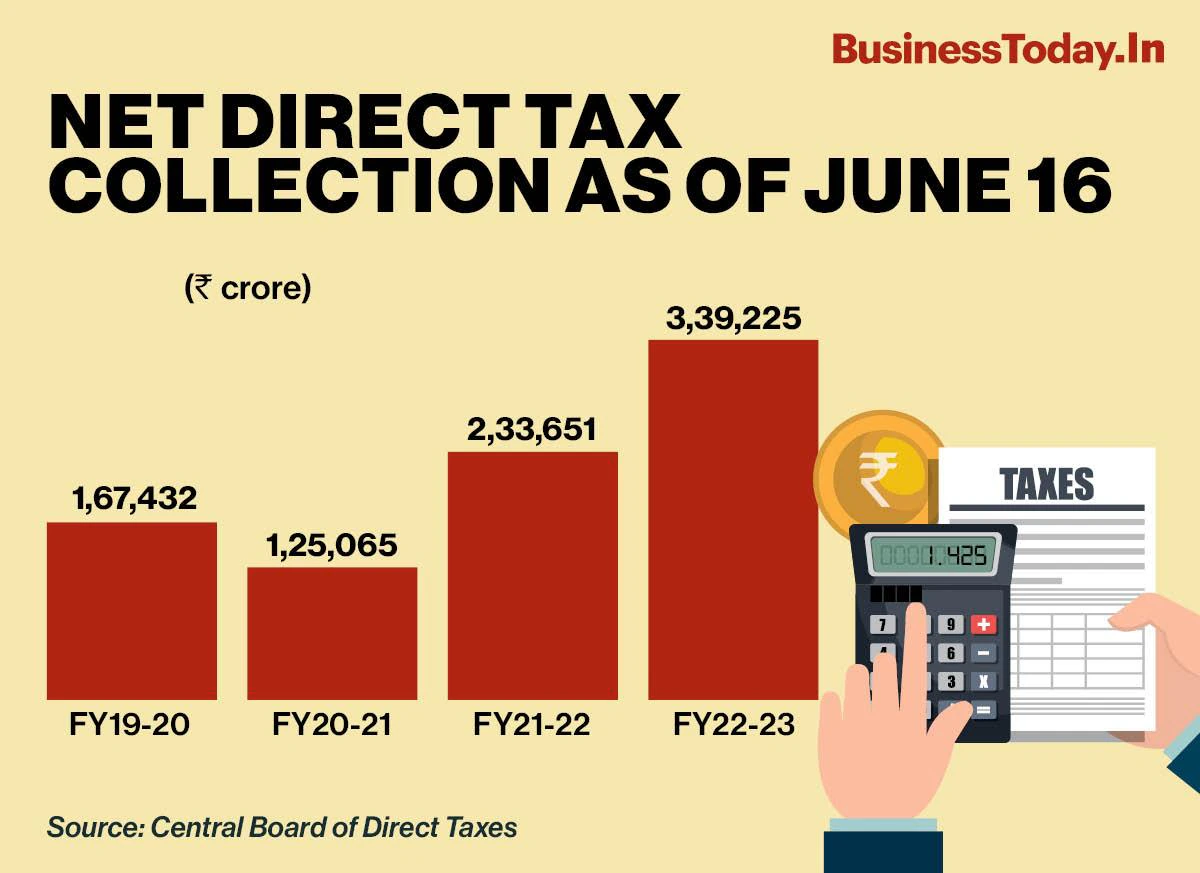

Net-Direct Tax collections

News: Boosted by the first installment of advances taxes, net direct tax collections grew 11.18 per cent to Rs 3,79,760 crore till June 17 in the current financial year, according to data released by Finance Ministry.

Background:

• As per the Budget 2023-24, direct tax collections are estimated to be Rs 18.23 lakh crore, of which Rs 9.22 lakh crore is estimated to come from corporate tax and Rs 9.01 lakh crore from income tax.

• The government had collected Rs 16.67 lakh crore as direct taxes in FY 2022-23.

What are Direct taxes?

• Direct taxes are taxes that are levied on the income or profits of people or organizations. They are paid directly by the taxpayers to the government and cannot be shifted to someone else. Direct taxes are governed by the Central Board of Direct Taxes (CBDT) in India.

• Example – Income Tax, Corporation Tax, Capital Gains Tax, Securities transaction tax.

What are positive impacts of rise in Direct tax collections?

• It can indicate a recovery of economic activity and income levels after the pandemic-induced slowdown.

• It can also reflect improved tax compliance and efficiency of tax administration.

• It can help the government meet its fiscal deficit target and reduce its borrowing requirement. It can also enable the government to increase its spending on public welfare and infrastructure projects.

• It can benefit the taxpayers by creating a scope for rationalization of tax rates and slabs, as well as providing relief measures and incentives. It can also enhance the trust and confidence of the taxpayers in the tax system.

Several reforms taken by Government of India to improve tax collections:

• Reducing corporate tax rates - The government has reduced the corporate tax rates from 30% to 22% for existing domestic companies and from 25% to 15% for new domestic manufacturing companies, subject to certain conditions. This is aimed at boosting investment, growth and employment in the country.

• Vivad se Vishwas Scheme - Under this scheme, taxpayers can settle their disputes by paying only the disputed tax amount and get a waiver of interest and penalty. This is expected to reduce litigation, generate revenue and create trust between the taxpayers and the tax authorities.

• Simplification of Income tax return filing – Pre-filled forms, faceless assessment, faceless appeal, e-PAN etc.

• Several reforms within the IT department and strengthening of Indian economy have also helped in higher direct tax collections.

• Revising direct tax code - The government has constituted various committees such as Arbind Modi Committee on Income Tax Reforms and Akhilesh Ranjan Panel on formulating a new Direct Tax Code (DTC), which aim to revise, consolidate and simplify the structure of direct tax laws in India into a single legislation.

Source – The Indian Express

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com