Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Insurance Sector of India

News: Recently, The Standing Committee on Finance of the Lok Sabha has given recommendations to boost the insurance segment in the country.

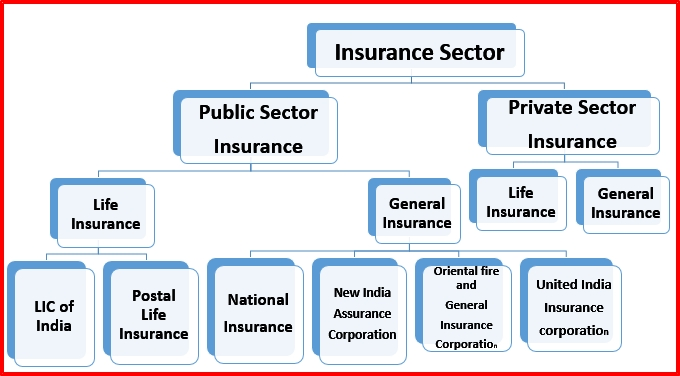

Insurance sector in India:

General Insurance:

• The total insurance premium in India increased by 13.5% in 2021.

• India is the 10th largest market globally and the 2nd largest of all emerging markets in terms of total premium volumes.

• Over two-fifths (41%) of households have at least one usual member covered under health insurance.

Life Insurance:

• India’s insurance penetration was pegged at 4.2% in FY21, with life insurance penetration at 3.2%.

• In terms of insurance density, India’s overall density stood at US$ 78 in FY21.

• Premiums from India’s life insurance industry is expected to reach Rs. 24 lakh crore (US$ 317.98 billion) by FY31.

• According to the latest Economic Survey, only 3 people out of 100 have a life insurance policy in India.

What are the challenges faced by the Insurance sector in India?

• Low Insurance Penetration: The insurance penetration rate in India is low compared to other countries. This is particularly true in rural areas, where life insurers, especially private ones, tend to focus on the urban population.

• Underinsurance and Underserved Markets: Despite the growing economy, a large portion of the population remains underinsured or uninsured, particularly in sectors such as agriculture and the informal economy.

• Fraud: Fraud is a major challenge in the insurance sector in India.

• Talent Management: There is a need for skilled professionals in the insurance sector.

• Claims Management: Efficient claims management is a challenge in the insurance sector.

• Lack of Adequate Capital Investments: Insufficient capital makes it difficult for insurers to expand into unpenetrated areas and affects their financial standing.

• Lack of Product Innovation: The insurance sector in India has been slow in product innovation.

Recommendations made by Standing committee on Finance:

• Composite Licensing: The committee recommended that insurance companies should be allowed composite licensing. This will enable an insurer to offer both life and non-life insurance products, including health, motor, and term policies. A composite license can cut costs and compliance hassles for insurers, as they can run different insurance lines under one roof.

• Reduction in GST Rates: The committee proposed a reduction in GST rates from the current level of 18% in the case of health insurance and term policies. The high rate of GST results in a high premium burden, which acts as a deterrent to getting insurance policies.

• Catastrophe Insurance: The committee recommended that the government should explore options as to how homes and properties, especially those of economically vulnerable groups, can be insured in areas susceptible to catastrophic damages with the aid of Central/State Government.

• An inter-ministerial working group with participation from IRDAI, National Health Authority, other concerned agencies, consumers, healthcare providers and health insurers should be established.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com