Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Inflation Targeting

News: The Centre, under section 45ZA of the RBI Act, 1934, has fixed the CPI inflation target at 4% with an ‘upper tolerance limit’ of 6%.

• However, actual year on year inflation in 2022 has ruled above 6% every single month from January to

August.

• If it does so in September as well, the RBI, under section 45ZN of the same law, will have to submit a report to the centre on ‘the reasons for failure to achieve the inflation target’ and ‘remedial actions proposed to be taken by the bank’.

• Failure here is defined as inflation being more than the upper tolerance level of the target ‘for any 3 consecutive quarters’

About Inflation Targeting framework:

• Price stability is a necessary precondition for macroeconomic and financial stability. Thus, price stability remains the dominant objective of the monetary policy.

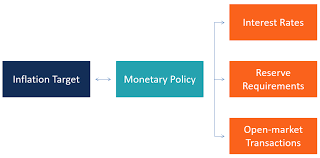

• Under Inflation Targeting Framework, the central bank specifies an inflation rate as a goal and adjusts its monetary policy to achieve the specified annual inflation rate.

• Based on the Urjit Patel committee recommendation (2014), Government of India and RBI also signed the Monetary Policy Framework Agreement in 2015.

• The RBI Act, 1934 was amended in 2016 to make inflation targeting the nominal anchor of RBI’s monetary policy and to establish a monetary policy committee (MPC).

| What is MPC? • MPC is a six-member body to set the policy rate (repo rate) to achieve the inflation target while keeping in mind growth objectives. • Composition - 3 internal members of RBI (including RBI Governor as Chairman) and 3 external members appointed by government. • The MPC is required to meet at least 4 times in a year. • Quorum – At least 4 members need to be present for the meeting. • Decision making - One vote of each member with RBI Governor having a second or casting vote in case of equality of votes. |

What are the advantages of Inflation Targeting?

Transparency

• It ensures transparency as CPI numbers are released every 12 days.

• Inflation is well understood by the people in simple and easy terms and thus even public can form perception about RBI’s work.

Credibility of objectives

• No one can put pressure on RBI to change monetary policy as its aim is to control inflation.

• A single minded objective is likely to bring more likelihood of success.

Global acceptance

• Inflation targeting is part of many central bank’s policies since late 20 th century.

Predictable Policy Framework

• With price stability as unambiguous and sustainable goal, the policy becomes more predictable.

• Reduced inflation volatility and reduced impact of shocks as central banks try and work in tandem with ongoing world realities.

What are the recent developments in India as far as inflation is concerned? Has the Inflation targeting framework actually worked?

• During Narendra Modi government’s first term, roughly from April 2014 to March 2019 (Modi 1.0), CPI inflation was above 6% only in 6 out of 60 months. 5 of those 6 months were in 2014 before the RBI act was amended.

• However, in 41 months since April 2019 (Modi 2.0), inflation has exceeded 6% in as many as 21 months. In other words, a failure rate of over 50%, as against 10% during Modi 1.0.

• Also, average CPI inflation was 4.5% during Modi 1.0, whereas it has been 5.7% so far in Modi 2.0. (Make note of this data)

Why has RBI failed to adhere to inflation-targeting mandate?

• Food and beverage items with a combined weight of 45.86% in the overall CPI has been main cause of overall rise in inflation. During Modi 1.0, food inflation was lower than general inflation in 38 out of 60 months. However, in Modi 2.0, the average consumer food price inflation (CFPI) index at 6.3% is more than 5.7% for general inflation.

• The preponderant weight of food items in the Indian consumption basket and hence its CPI – in contrast to developed countries where their shares are hardly 10-25% - makes inflation much less amenable to control through repo interest rate or cash reserve ratio hikes. Therefore, the RBI is forced to rely on government action to meet inflation target.

• Thus the RBI has to rely more on supply side measures by the government. This effectively translates into monetary dependence, not independence. Recent supply side measures taken by the government to tame inflation include – ban of export of wheat, exports of broken rice was prohibited and bringing down effective duty on crude and refined palm oil to name a few.

• Other factors such as war in Ukraine, pandemic and extreme weather events such as heat wave in March April, excess rains during September-January 2021-22 and deficient monsoon in some parts of the country along with skyrocketing prices of fuel (6.85% weight in CPI) have rendered the RBI’s demand- side toolkit to fight inflation ineffective.

Way Forward:

• Pre-emptive monetary policy action to reinforce credibility of monetary policy intent and action to fight supply-side inflation and contain the negative impact on growth.

• Use of different inflation targets to serve different classes. For example, lower inflation (3-4%) tolerance on food items or staples consumed by the poor to kick start policy action can make it more beneficial for all classes.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com