Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

IDBI Strategic Disinvestment

News: The Department of Investment & Public Asset Management (DIPAM) has issued a Request for Proposal (RFP) to engage an asset valuer for the strategic disinvestment of IDBI Bank.

Background:

• RFP for Asset Valuer - DIPAM, representing the Government of India (GoI) and LIC, seeks a reputable asset valuer registered with the Insolvency & Bankruptcy Board of India (IBBI) to value IDBI Bank’s assets and assist in the strategic disinvestment process.

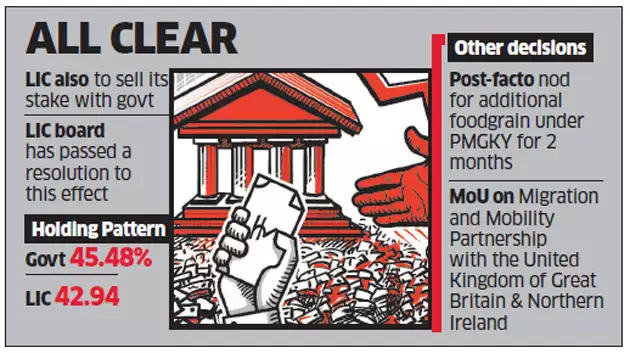

• Ownership Details - As of March 31, 2023, LIC holds 49.24% while the Government owns 45.48% of IDBI Bank.

• The strategic disinvestment plan aims to sell 30.48% of the Government’s stake and 30.24% of LIC’s stake, totaling 60.72% along with a transfer of management control in IDBI Bank.

Disinvestment in India:

• Disinvestment is the process of selling or liquidating government-owned assets, including Central and state public sector enterprises and fixed assets.

• Disinvestment is undertaken to reduce the fiscal burden on the government, helping it manage finances more effectively.

• It aims to raise funds for specific needs, such as bridging revenue shortfalls from other sources.

What is Strategic Disinvestment?

• Ownership Transfer - Strategic disinvestment involves transferring ownership and control of a public sector entity, often to a private sector entity.

• Privatization - It represents a form of privatization, with the government selling a substantial portion of its shareholding (up to 50% or more) in a central public sector enterprise (CPSE) and transferring management control.

• Economic Principle - Guided by the principle that the government should not engage in manufacturing or providing goods and services in sectors with competitive markets.

About DIPAM:

• DIPAM, formerly the Department of Disinvestment, operates under the Ministry of Finance. Functions:

• DIPAM handles the sale of Central Government equity in Central Public Sector Undertakings (PSUs) through methods like offer for sale, private placement, and other modes.

• It manages the Central Government’s equity investments, including the disinvestment of equity in Central PSUs.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com