Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Foreign Portfolio Investors

News: Recently, SEBI proposed additional disclosures from Foreign Portfolio Investors (FPIs).

Who are Foreign Portfolio investors?

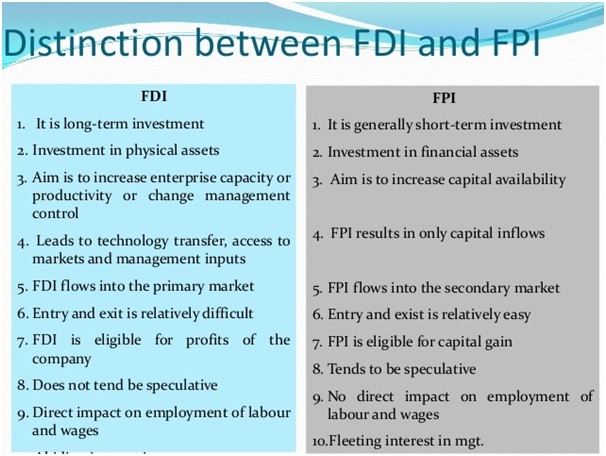

Foreign portfolio investors (FPIs) in India are non-residents or NRIs who invest in Indian securities such as shares, bonds, mutual funds, convertible securities, etc. They do not have direct or active ownership or control of these assets, but rather passive ownership.

According to Arvind Mayaram Committee (2014), FPI results in an investor controlling less than 10% of the shares of the company.

FPI regulations in India:

FPIs are registered with SEBI and can invest in Indian securities as per the regulations prescribed by SEBI.

The Foreign Exchange Management Act 1999 (FEMA) is the primary legislation governing FPI in India and has been amended several times to liberalize FPI regulations in India.

What are SEBI’s new proposals?

It categorizes FPIs into low risk, moderate risk and high risk.

The low risk would cover government and government-related entities such as central banks or sovereign wealth funds.

Moderate risk refers to pension funds or public retail funds with widespread and dispersed investors.

All other FPIs are categorised as high-risk.

Additional disclosure requirements for high-risk FPIs holding more than 50% of their equity asset under management (AUM) in a single corporate group.

The existing high-risk FPIs with an overall holding in the Indian equity market of over Rs 25,000 crore comply with the disclosure mandate within six months. Failing this, they would have to bring down their holding within the threshold.

What was the need of the proposed regulations?

Potential misuse of the FPI route for circumventing Press Note 3 stipulations (2020) which required an entity sharing a land border with India to involve in FPI only via the government route.

Concentrated group investments by FPIs to bypass regulatory requirements (such as that for minimum public shareholding).

Significance:

It will help identify tangible ownership and curtail incidences of multiple routes.

It will enhance transparency and help avert regulatory requirements, and keep up with the minimum (25%) public shareholding norms.

Are there any exceptions?

New FPIs that have just begun investments would be allowed to breach the threshold criteria for up to a period of six months.

‘Moderate risk’ FPIs, whose India-oriented holdings are relatively small in comparison to their global portfolio, are not subjected to additional disclosure requirements.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com