Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

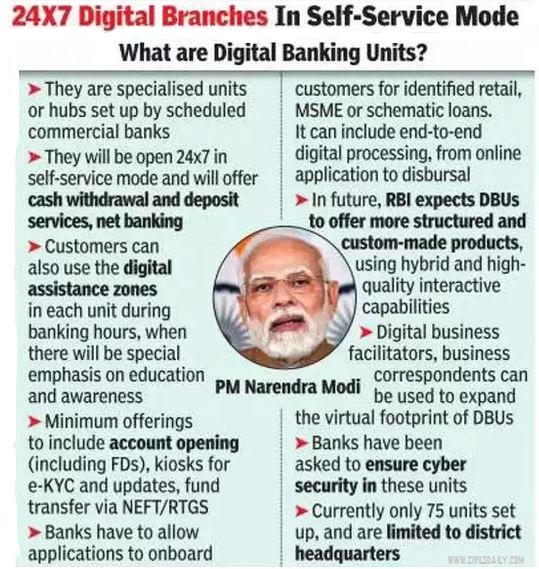

Digital Banking Units

News: Finance Minister Nirmala Sitharaman has reiterated her Budget announcement on setting up 75 digital banking units in 75 districts of the country this year.

About:

• Digital banking involves taking all traditional banking activity online - doing away with paperwork like cheques, pay in slips, demand drafts and so on.

• A digital banking unit is a specialised fixed point business unit or hub housing certain minimum digital infrastructure for delivering digital banking products and services as well as servicing existing financial products and services digitally in self-service mode at any time.

• Commercial banks (other than regional rural banks, payment banks and local area banks) with past digital banking experience are permitted to open DBUs in tier 1 to tier 6 centres, unless otherwise specifically restricted, without having the need to take permission from the RBI in each case.

Services they may offer:

• As per the RBI, each DBU must offer certain minimum digital banking products and services.

• The services include savings bank accounts under various schemes, current accounts, fixed deposits and recurring deposit accounts, digital kit for customers, mobile banking, Internet banking, debit cards, credit cards, and mass transit system cards.

Advantages of DBU:

• Digital banking units will help banks themselves which are now looking to reduce physical footprint with fewer brick and mortar branches, with a ‘light’ banking approach.

• It will increase penetration in rural market for banks.

• Cheaper to establish as compared to opening up entire new branch.

• Such units also require lesser staff, with cheaper maintenance due to technological tools and hence can be high-yield units for the parent bank.

• It will help increase financial literacy.

Given the rapid rise of Digital transactions and increasing awareness regarding financial literacy in the nation coupled with Fintech innovations, it becomes critical to develop digital infrastructure to support Digital banking. It will pay increasing dividends for the years to come.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com