Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Debt Burden in India

News: International Monetary Fund recently highlighted long-term sustainability concerns about India’s Debt burden.

Background:

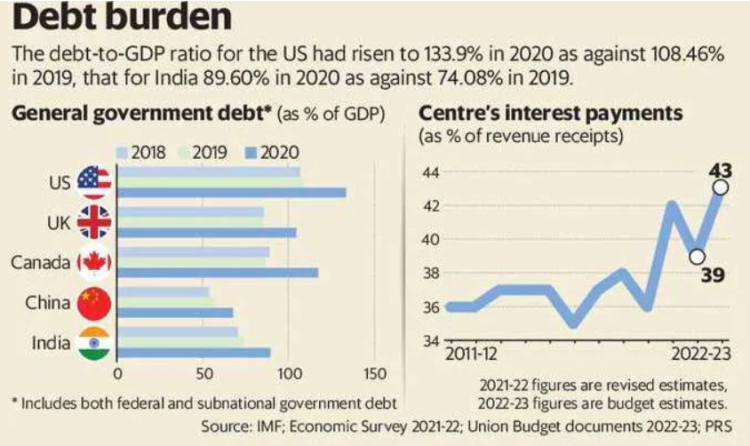

• The IMF states that India’s government debt could be 100% of GDP under adverse circumstances by fiscal 2028.

• Long-term risks are high because substantial investment is needed to reach India’s climate change mitigation targets and improve resilience to climate stresses and natural disasters.

What is Public Debt?

• Public debt, also known as sovereign debt, refers to the outstanding loans borrowed by a government from individuals, financial institutions, companies, other nations, or international organizations.

• Governments often borrow money domestically or internationally to meet the nation’s financial needs. The loan could be for the short, medium, or long term. The public debt helps a government run, build, and develop the country.

Status of Public Debt in India:

• The Union government’s debt was ₹155.6 trillion, or 57.1% of GDP, at the end of March 2023 and the State Government’s Debt was about 28% of GDP.

• According to Finance Ministry, India’s public debt-to-GDP ratio is 81% in 2022-23.

• It is however higher than suggested by FRBM Act, the 2018 amendment to the Union government’s FRBM act specified debt-GDP targets for the Centre, States and their combined accounts at 40%, 20% and 60%, respectively.

How does Borrowing help the Government?

• Recession Management: If there is a downturn in the economy, government borrowing can help stabilize the economy by maintaining demand. Without government borrowing, demand would fall more.

• Investment in Public Services: Government borrowing can fund investments in public services like education or public transport. In the short run, this may cause a deficit, but if these investments increase productivity, then in the future there will be a higher rate of economic growth and more tax revenues.

• Promotes National Savings: As citizens buy government bonds, it promotes national savings.

• Infrastructure Development: Borrowing allows for increased spending on infrastructure projects, education, healthcare, and other public services. Such investments can drive economic activity, create jobs, and contribute to long-term development.

• Debt Refinancing: Governments also borrow to refinance existing debt. This involves replacing old debt with new debt that has better terms or lower interest rates, reducing the overall cost of debt servicing.

• Poverty Alleviation: The funds borrowed by the government can be used to undertake projects that help in building a sound economic foundation and lifting the economy out of the vicious circle of poverty.

What are the concerns with huge Debt Burden?

• Higher Debt Servicing Costs: As the debt increases, so do the interest payments on that debt.

• Financial Stability: High levels of fiscal deficit and public debt can pose a critical challenge to a country’s financial stability.

• Interest Rates: An excessive level of public debt can result in higher interest rates, which can crowd out private investment in the economy and slow down the rate of economic expansion.

• Reduced Fiscal Flexibility: High debt levels can limit a government’s ability to respond to economic downturns or emergencies. It limits fiscal policy options, as a substantial portion of the budget might already be committed to servicing the debt, limiting the ability to spend on critical needs or implement stimulus measures.

• Inflation: If the debt is taken to extremes, it can cause inflation. If the government fulfills its debt by printing more money, then the value of that money goes down.

• Sovereign Credit Ratings: The debt level of a country can affect its sovereign credit ratings, which can impact the country’s ability to borrow in the future.

• Pressure on Future Generations: Excessive debt burdens can pass on economic challenges to future generations. They might inherit a weaker economy, higher taxes, reduced public services.

Way Forward

• Governments must aim for balanced budgets or surpluses during economic expansions to create buffers for potential downturns.

• Proper communication regarding Fiscal policy and proper interest rate transmission should be carried out between RBI and banks.

• Invest in areas that yield long term economic gains such as infra, education and healthcare.

• Diversify and minimize risk potential by borrowing prudently between short term and long term debt sources.

• Improve Government’s sources of tax revenu

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com