Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Coping with Fiscal effects of Energy Transition

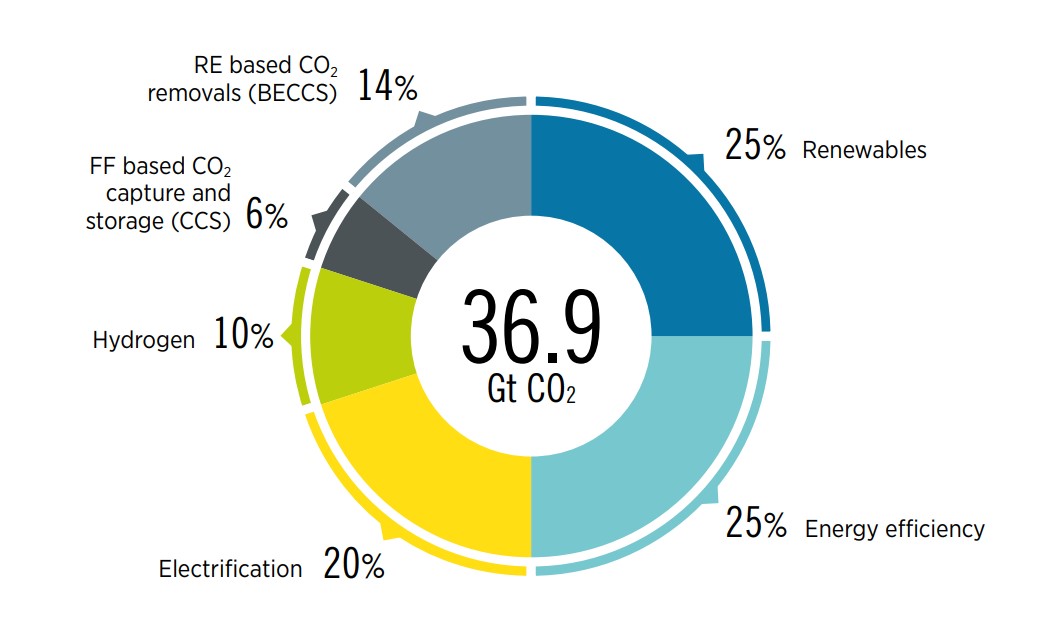

Energy Transition are gaining momentum worldwide, and India is no exception. It has created one of the world’s largest markets for renewable energy. However, this transition is going to be a complex task keeping in mind the fiscal impacts of it. Also, ensuring that the opportunities of India’s transition are shared fairly throughout society is not an easy task, given the country’s population and diversity.

India’s Fiscal Dependence of Fossil Fuels:

• As per document published by IMF, governments’ (both centre and state) revenue from coal, oil and natural gas, will be affected over the next two decades as India shifts towards renewable energy sources.

• Revenues would fall significantly as a share of GDP and overall government budget.

• As of 2019, more than a fifth of the Centre’s revenues were from fossil fuels including both tax (both direct and indirect) and non-tax revenues (including royalties, dividends etc.) paid by public sector undertakings (PSUs).

• The combined revenue for both the Centre and States was 13% of the total revenue collected, which translates to 3.2% of India’s GDP.

Concerns associated with Energy Transition:

• Over time the revenues from fossil fuel will steadily fall as India shifts to renewable energy sources, narrows down the use of fossil fuels, and as electric vehicles (EVs) increase.

• A large part of the energy transition may need to be supported through direct or indirect subsidies by concession of excise duty on EVs, concessional GST on electric cars, concessions given under Green Hydrogen Policy etc. like the Small wind energy and Hybrid systems programme.

• The 21st report of the Standing Committee on Energy (2021-22) on financial constraints in the renewable energy sector highlights that India’s long-term RE commitments require ₹1.5-2 trillion annually. Actual investments in the last few years have been around ₹75,000 crore.

What must India do to cope with Fiscal Transition?

• When the government experiences revenue stress, it finds energy to be the easiest source of revenues. Additional taxes on coal or probably a carbon tax can be imposed.

• Just as we need strong climate policies, we also need strong social policies and local institutions to ensure that the clean energy transition is fair and just.

• The Budget 2022 announced that the government proposes to issue sovereign green bonds to mobilise resources for green infrastructure. These bonds are expected to be serviced by rupee revenues, with rupeedenominated end use. This makes strong case for domestic as well as ‘masala bonds’ issuances overseas.

• Several Indian corporates have tapped the India International Exchange (India INX) to raise capital from international investors. India’s immense requirements for green finance could be turned into an advantage to develop a homegrown but world-facing capital market.

• A gender balanced transition is the need of the hour. India’s energy transition is likely to create many jobs, but limited participation of women in the growing green workforce must be addressed.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com