Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Climate Financing

News: Recently, the Finance Minister of India and her US counterpart met for the eighth ministerial meeting of the U.S.-India Economic and Financial partnership.The major highlight of the ministerial meeting is that it discussed climate finance for the first time under the aegis of Climate Action and Finance Mobilization Dialogue (CAFMD).

Details:

• Climate finance refers to local, national, or transnational financing—drawn from public, private, and alternative sources of financing—that seeks to support mitigation and adaptation actions that will address climate change.Climate finance is needed for mitigation because large-scale investments are required to significantly reduce emissions.It is equally important for adaptation, as significant financial resources are needed to adapt to the adverse effects and reduce the impacts of a changing climate.

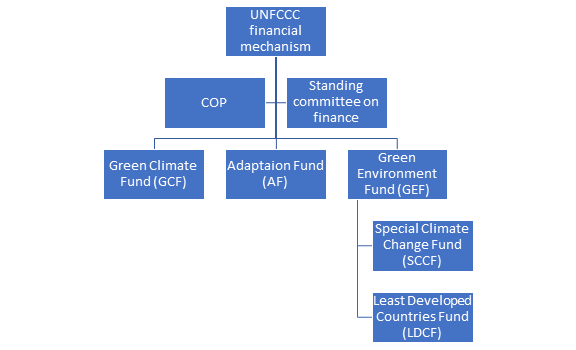

• To facilitate the provision of climate finance, the United Nations Framework Convention on Climate Change (UNFCCC) has established the financial mechanism to provide financial resources to developing country Parties.

• The Adaptation Fund under Kyoto Protocol: It aims to finance concrete projects and programmes that help vulnerable communities in developing countries that are Parties to the Kyoto Protocol to adapt to climate change.

• Green Climate Fund is the financial mechanism of the UNFCCC, established in 2010.

• India has been pushing for rich countries to meet their Paris Accord climate finance commitment of USD 100 billion per year.

• Global Environment Fund has served as an operating entity of the financial mechanism since the Convention came into force in 1994.It is a private equity fund focused on seeking long term financial returns by investments in clean energy under climate change.GEF also maintains two additional funds, the Special Climate Change Fund (SCCF) and the Least Developed Countries Fund (LDCF).

Climate Financing in India:

• National Adaptation Fund for Climate Change (NAFCC) was established in 2015 to meet the cost of adaptation to climate change for the State and Union Territories of India that are particularly vulnerable to the adverse effects of climate change.

• National Clean Energy Fund was created to promote clean energy, funded through an initial carbon tax on use of coal by industries.

• Governed by an Inter-Ministerial Group with the Finance Secretary as the Chairman.Its mandate is to fund research and development of innovative clean energy technology in the fossil and non-fossilfuel based sectors.

• National Adaptation Fund was established in 2014 with a corpus of Rs. 100 crores with the aim of bridging the gap between the need and the available funds.The fund is operated under the Ministry of Environment, Forests and Climate Change (MoEF&CC).

| Principles of Climate Finance Polluter Pays: The 'polluters pays' principle is the commonly accepted practice according to which those who produce pollution should bear the costs of managing it to prevent damage to human health or the environment.This principle underpins most of the regulation of pollution affecting land, water and air formally known as the 1992 Rio Declaration.It has also been applied more specifically to emissions of greenhouse gases which cause climate change. Common but Differentiated Responsibility and Respective Capability (CBDR–RC): CBDR–RC is a principle within the UNFCCC. It acknowledges the different capabilities and differing responsibilities of individual countries in addressing climate change. Additionality: Climate finance should be additional to existing commitments to avoid the diversion of funding for development needs to climate change actions.This includes use of public climate finance and investments by the private sector. Adequacy & Precaution: To take precautionary measures to prevent or minimise the causes of climate change as a stated goal under UNFCCC, the level of funding needs to be sufficient to keep a global temperature within limits as possible.A better level of adequacy might be increased in the national estimates of the needed climate funds, this will help build planned investments with respect to INDC. Predictability: Climate finance must be predictable to ensure sustained flow of climate finance.It can be done through multi-year, medium-term funding cycles (3 – 5 years).This allows for an adequate investment program to scale up the country's national adaptation and mitigation priorities. |

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com