Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

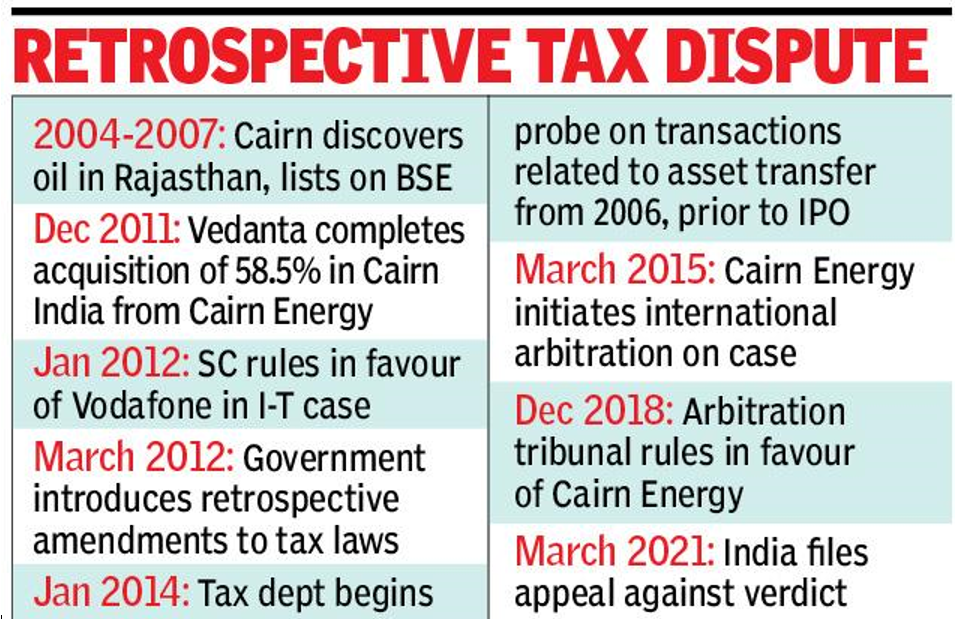

Changes in Income Tax for Retrospective Taxation

News: The Union Budget 2022-23 brought in some amendments to the Income Tax (IT) Act 1961 that would be effective retrospectively.

What is a Retrospective Tax?

• A retrospective tax is one that is charged for transactions in the long past. It can be a new or additional charge on transactions done in the past.Ideally, retrospective tax is to make adjustments when policies in the past and the present are so vastly different that tax paid before under the old policy could be said to have been less. Retrospective tax could correct that situation by charging tax under the existing policy.

• Retrospective taxation allows a nation to implement a rule to impose a tax on certain products, goods or services and deals and charge companies from a time before the date on which the law is passed.

• Countries use this form of taxation to rectify any deviations in the taxation policies that, in the past, allowed firms to take benefit from any loophole. It affects companies that had unknowingly or knowingly used the tax rules differently.Not only India, but many other countries like the US, UK, Australia, Netherlands, Belgium, Canada, and Italy have retrospectively taxed firms.

Highlights of major amendments:

• Making a retrospective amendment to the IT Act from 2005-06, the Budget has clarified that cess and surcharge will not be allowed to be claimed as deductions in the form of expenditure, a practice that some companies and businesses were resorting to in the absence of legal clarity.

• Citing some court rulings over the years that had given benefit to taxpayers in claiming cess as expenditure and not tax, the tax department said the retrospective amendment is being done to correct the anomaly.

• This amendment will take effect retrospectively from 1st April, 2005 and will accordingly apply in relation to the assessment year 2005-06 and subsequent assessment years.The change is being brought from AY 2005-06 as education cess was brought in for the first time by the Finance Act, 2004.

• The court rulings differentiated between income tax and education cess on income tax, and in absence of a specific disallowance for ‘education cess’, courts had taken a view beneficial for taxpayers in many cases.

• In order to nullify the effect of such court rulings and to consider such rulings against the intention of the law, a clarificatory amendment has been introduced in the income tax law, providing that any surcharge or education cess on income tax shall not be allowed as business expenditure.

• The government has also allowed exemption of the amount received for medical treatment and on account of death due to Covid-19 retrospectively from April 2020.Any sum of money received by an individual, from any person, in respect of any expenditure actually incurred by him on his medical treatment or treatment of any member of his family, in respect of any illness related to Covid-19 subject to such conditions, as may be notified by the Central Government in this behalf, shall not be the income of such a person.

• It has also allowed exemption for amount received by a member of the family of a deceased person, from the employer of the deceased person (without limit), or from any other person or persons with such money not exceeding Rs 10 lakh, where the cause of death of such person is illness relating to Covid-19, and the payment is received within twelve months from the date of death of such person.Separately, gifts and freebies to doctors shall not be treated as business expenditure under the Income-tax Act.

• This has clarified that any expense incurred in providing various benefits in violation of the provisions of Indian Medical Council (Professional Conduct, Etiquette and Ethics) Regulations, 2002 shall be inadmissible under law.This step is likely to discourage pharma companies from giving freebies to medical professionals, and claim these expenses as deductions.

Funding of Companies:

• Government has made changes to the IT law, making space for questioning by the tax department to explain the source of funds at the hands of the creditor.

• A provision has been introduced stating that the source of funding for loan and borrowings for a recipient will be treated as explained only if the source of funds is also explained in the hands of the creditor.

• This could have an impact on funding of businesses, especially startups, if the creditor is not a venture capital fund, a venture capital company registered with SEBI.

• Earlier, if any company used to have bogus entries, the taxpayer would just provide details such as PAN and other financial details of the creditor and that was enough for the tax department.Now, it’s upon the recipient to prove that it’s the right source of income and they had the right net worth to provide this amount.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com