Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Centre rules out Legal status to MSP

News: The recent farmer protests in Haryana, Punjab have once again brought the issue of Minimum Support Price (MSP) to the forefront.

What is MSP?

• It’s a price set by the government to purchase crops from the farmers, regardless of the market price for the crops. The MSP system in India is fundamental in providing price support to farmers for their agricultural produce, thereby ensuring remunerative prices and income security.

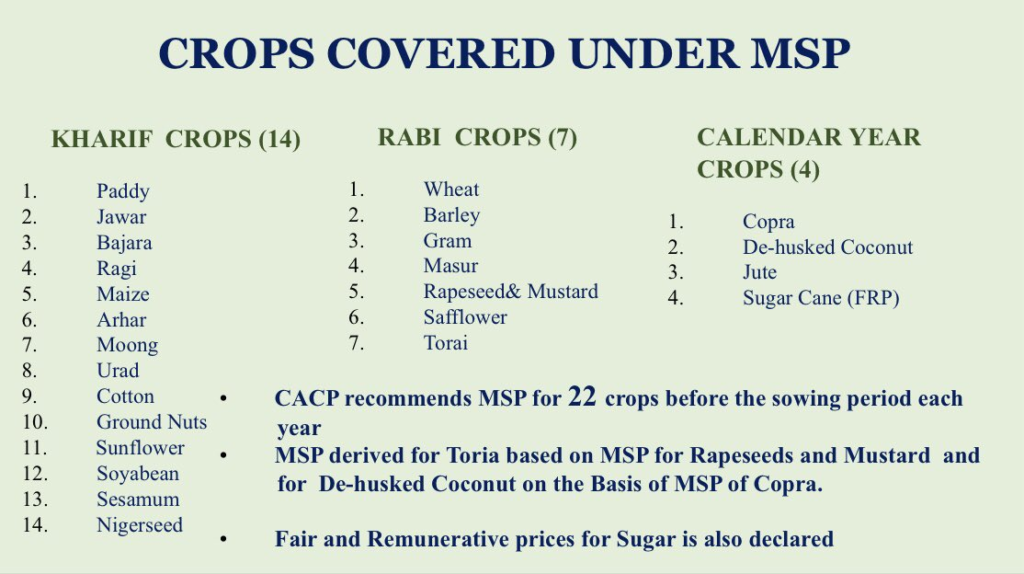

• The MSPs are announced by the Government of India at the beginning of the sowing season for certain crops on the basis of the recommendations of the Commission for Agricultural Costs and Prices (CACP).

• The major objectives of MSP are to support the farmers from distress sales and to procure food grains for public distribution. In case the market price for the commodity falls below the announced minimum price due to bumper production and glut in the market, government agencies purchase the entire quantity offered by the farmers at the announced minimum price.

What are benefits of giving legal status to MSP?

• Guaranteed Minimum Income: Legalizing MSP would ensure that farmers are guaranteed a minimum income for their produce.

• Protection Against Market Fluctuations: MSP provides a safety net for farmers against excessive drop in price during market fluctuations.

• Increased Demand and Employment: By giving legal status to MSP, the extra income would flow from the private sector to the farmers, who will spend it and create more demand in the economy. This could lead to an increase in employment and investment.

Concerns associated with Legalizing MSP:

• Implementation Challenges: The implementation of a legal MSP regime presents practical challenges, including the need for certain infrastructure that may be difficult to implement. The government may not have the necessary physical resources to store large quantities of produce.

• Financial Burden on Government: The government would also be faced with the concern of procurement and the expenditure to make those procurements.

• Market Distortions: Legalizing MSP could discourage competitive pricing and could lead to market distortions.

• Overproduction of Certain Crops: Legalisation of MSP could encourage over-production of certain crops like rice and wheat. This may have severe environmental costs such as decline in soil fertility, depletion of ground water etc.

• WTO subsidy Principle: It will violate the subsidy principle of WTO according to which subsidies which are market distortionary should be abolished.

• Inflation: Higher costs of procurement due to a statutory MSP could increase food prices, leading to inflation in the economy.

How is MSP calculated?

The Minimum Support Price (MSP) is calculated by considering both the explicit and implicit costs incurred by farmers.

• Explicit Costs: These cover expenses like chemicals, fertilisers, seeds, and hired labour.

• Implicit Costs: These include factors such as family labour and rent.

These variables are represented by A2, FL, and C2

• A2 refers to the expenses for inputs like chemicals, fertilisers, seeds, and hired labour for crop growth, production, and maintenance.

• FL includes the value of family labour.

• C2 incorporates A2 + FL along with fixed capital assets and rent paid by farmers. It represents the total cost of production and ensures a reasonable return on investment for farmers.

In addition to these costs, the Commission for Agricultural Costs and Prices (CACP) also takes into account various other factors:

• Cost of cultivation per hectare and crop costs in different regions.

• Cost of production per quintal and regional differences.

• Market prices of relevant crops and their fluctuations.

• Other production and labour costs, along with associated changes.

• Prices of commodities bought or sold by farmers and any fluctuations.

• Information on product supply, including area, yield, production, imports, exports, and stocks with public agencies or industries.

• Demand information across regions, including total and per capita consumption, processing industry trends, and capacity.

• After the CACP submits its recommendations, the Cabinet Committee on Economic Affairs (CCEA), chaired by the Prime Minister of India, makes the final decision on MSP levels.

What else should you know?

• The MS Swaminathan Commission, in its report, recommended that the government should raise the MSP to at least 50 per cent more than the weighted average cost of production (C2+ 50 per cent formula). This formula includes the imputed cost of capital and land rent, providing farmers with a fair return on their investment.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com