Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Centralization of India’s Fiscal Federalism and its consequences

What is Fiscal Federalism?

• It refers to how federal, state and local governments share funding and administrative responsibilities within our federal system.

Background of India’s Fiscal Federalism

• The Government of India Act, 1935 was more Federal in nature than the Constitution adopted on January 26 th , 1950, as the GOI Act, 1935 offered more power to its provincial governments.

• India was a ‘holding together federalism’ in contrast to the ‘coming together federalism,’ in which smaller independent entities come together to form a federation (as in the United States of America).

• B.R. Ambedkar in Constituent Assembly said “In politics we will have equality and in social and economic life we will have inequality. These conflicts demanded attention: fail to do so, and those denied will blow up the structure of political democracy.”

• Anticipating this threat of centralisation, the Tamil Nadu government, constituted a committee under Justice P.V. Rajamannar in 1969, the first of its kind by a State government. The committee looked at Centre-State fiscal relations and recommended more transfers and taxation powers for regional governments.

Present structure of Fiscal Federalism

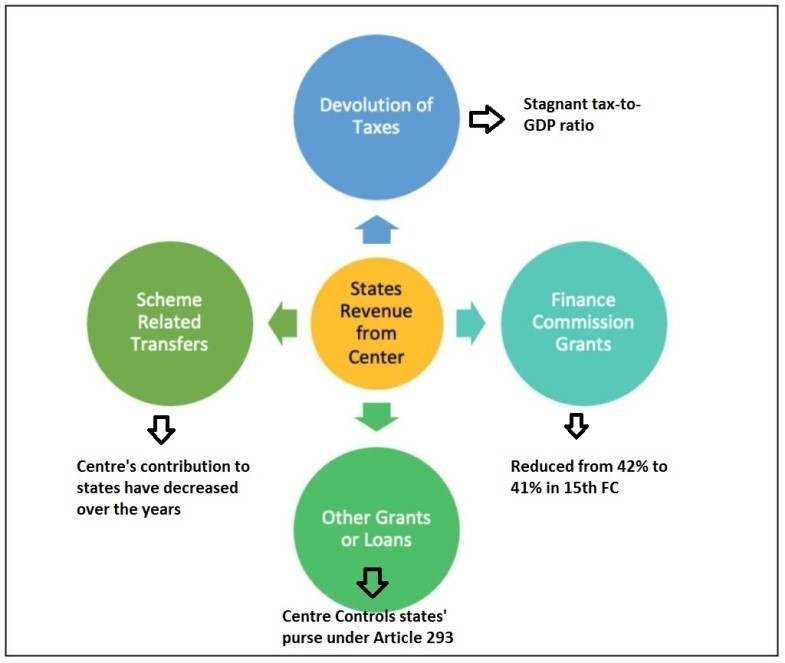

• India’s fiscal transfer worked through two pillars, the Planning Commission and the Finance Commission. Ever since the abolition of the Planning Commission, the Finance Commission became the major means of fiscal transfer.

What is the status of State’s revenues and expenditure?

• The ability of States to finance current expenditures from their own revenues has declined from 69% in 1955-56 to less than 38% in 2019-20.

• While the expenditure of states has been increasing, but their revenues did not.

• States cannot raise tax revenue because of curtailed indirect tax rights (under GST). Their revenue has been stagnant at 6% of GDP in the past decade.

Instances that hamper Fiscal Federalism in India

• The states have lost the autonomy to decide the tax rates of the subjects that fall under state list after the introduction of GST. The inability of states to fix tax rates to match their development requirements implies greater dependence on the centre for funds.

• Even the increased share of devolution, mooted by the Fourteenth Finance Commission, from 32% to 42%, was subverted by raising non-divisive cess and surcharges that go directly into the Union kitty. This non- divisive pool in the Centre’s gross tax revenues shot up to 15.7% in 2020 from 9.43% in 2012, shrinking the divisible pool of resources for transfers to States.

• Instead of strengthening direct taxation, the Union government slashed corporate tax from 35% to 25% in 2019 and went on to monetize its public sector assets to finance infrastructure.

• States are forced to pay differential interest about 10% against 7% by the Union for market borrowings. The Centre has been setting the limits on the market borrowings of States under Article 293 of the constitution. This goes against their autonomy.

• During Covid-19, the central government suspended the MPLAD scheme and diverted that money to the Consolidated Fund of India leading to the centralization of the country’s financial resources.

• The issue of Centrally sponsored schemes (CSSs) where state’s expenditure pattern was distorted by the Centre’s involvement. There are 131 CSSs and states are required to share a part of the cost, most of the CSSs are driven by one-size fits all approach and are given precedence over state schemes. This undermines the electoral mandate by which state government’s come to power.

Consequences of Centralization of Fiscal measures

• Undermines democratically elected mandate and autonomy of states - By turning States into mere implementing agencies of the Union’s schemes, their autonomy has been curbed. It also undermines the electorally mandated democratic politics of States.

• Lower Tax to GDP Ratio - India has a poor record of taxing its rich. Its tax-GDP ratio has been one of the lowest in the world (17%) which is well below the average ratios of emerging market economies and OECD countries’ about 21% and 34%, respectively.

• Increased inequality - The poorest half of the population has less than 6% of the wealth while the top 10% nearly grab two-third of it’ (World Inequality Report)

• Impedes states from their charting their own path to development – Due to diversion of states resources for implementing CSSs.

What steps can be taken to ease the tensions?

• Working on the recommendations of the 15 th Finance Commission can be one way. Following are the recommendations:

• GST Council and the Finance Commission working need to be coordinated to optimize revenue targets.

• Giving Permanent status to Finance Commission.

• Relook at the 7th schedule by re-examination of entries of List I and List III as per changes in the polity, technology, and aspirations of society.

• Effective devolution of funds to local bodies through measures like more taxation powers, reforming the functioning of state finance commissions.

• The Punchi Commission in as early as 2007 made some recommendations for better Centre-State fiscal relations:

• Minimizing discretionary transfers, particularly those channeled through CSS.

• Expenditure liabilities on States for implementation of Central legislation should be fully borne by the Central Government.

• Ceiling on professional tax should be completely done away with.

• State-specific targets of fiscal deficit in the FRBM legislation of States.

• Reviving institutions like the Inter-State Council after the abolition of the planning commission will rebuild institutional capital.

Way Forward

• India’s fiscal federalism driven by political centralization has deepened socio-economic inequality, belying the dreams of the founding fathers who saw a cure for such inequities in planning.

• Thus only a buoyant tax system by increasing tax compliance and reviewing GST continuously can ease the battle for resources in our federal system.

• Mechanisms like the GST council will help nudge from competition to coordination over control of resources between union and states and minimize the mistrust that has grown in recent years.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com