Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

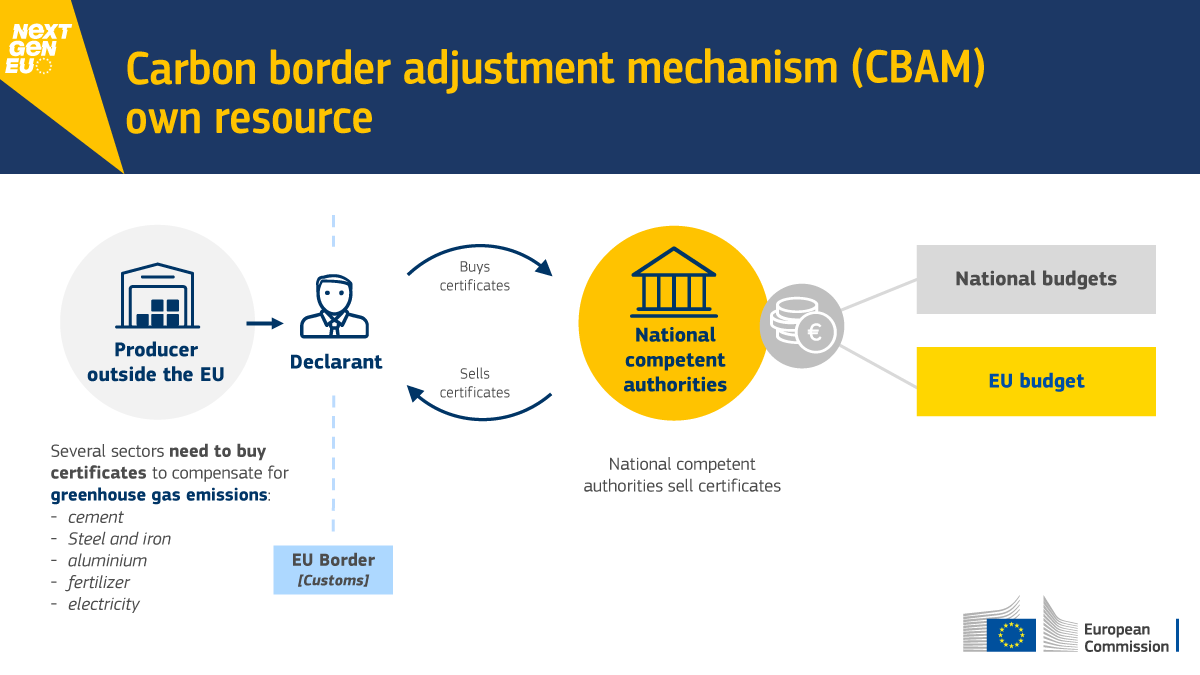

News: The European Union (EU) is most likely to introduce a Carbon Border Adjustment Mechanism (CBAM) in October.

o Under CBAM, The EU from 2026 onwards shall impose border taxes on imports of carbon-intensive goods such as steel, aluminum, cement, fertilizers and electricity through the carbon border adjustment mechanism (CBAM).

o The aim is to help slash the EU’s overall greenhouse gas emissions 55% below 1990 levels by 2030.

o It looks to ‘incentivize’ greener manufacturing around the world and to protect European industries from outside competitors who can manufacture products at a lower cost.

o The 27 EU member states have much stricter laws to control GHG emissions. It has an ‘Emissions Trading System ‘that limits how much GHG individual industrial units can emit; those that fail to cap their emissions can buy ‘allowances’ from those who have made deeper cuts. This makes operating within the EU expensive for certain businesses.

o Only in the past year, about a third of India’s iron, steel and aluminium exports were shipped to EU members. Engineering products are the largest export growth driver in recent years. Thus, it will impact Indian exports to Europe.

o According to data from the commerce ministry, India’s third-largest trading partner, the EU accounts for 11.1% of India’s total global trade.

o The additional cost of CBAM certificates for goods imported by the EU may distort prices of the goods in downstream industries, affecting the competitiveness of sectors like automobiles, electrical goods, machinery and equipment.

o The tax would create challenges for companies with a large greenhouse gas footprint.

o The tax is seen as a protectionist measure.

o The EU is essentially bypassing the principle of ‘Common But Differentiated Responsibilities’ and Respective capabilities (CBDR – RC) that should guide international climate action.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com