Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Facts for Prelims

Interchange Fee

News: The National Payments Corp. of India (NPCI), has introduced an interchange fee of up to 1.1% on merchant UPI transactions made via prepaid payment instruments (PPIs) like wallets and prepaid cards from 1 April.

Background:

The interchange fee will be applicable on specified categories of merchants such as online merchants, large merchants, and small merchants for transactions of over Rs 2,000 from April 1, 2023.

What are Prepaid payment instruments?

The RBI defines PPIs as payment instruments that facilitate the buying of goods and services, including the transfer of funds, financial services, and remittances, against the value stored within or on the instrument.

PPIs are in the form of payment wallets (like Paytm Wallet, Amazon Pay Wallet, PhonePe Wallet, etc.)), smart cards, mobile wallets, magnetic chips, vouchers, etc. As per the regulations, banks and NBFCs can issue PPIs.

What about sending money to friends and family via UPI?

The interchange fee will not be applicable to peer-to-peer (P2P) transactions or peer-to-peermerchant (P2PM) transactions between a bank and the prepaid wallet.

P2PM is the NPCI classification for small businesses which have a projected monthly inward UPI transaction of less than or equal to Rs 50,000. So, if one is sending money to friends, family or any other individual or a small business merchant’s bank account, it will not attract an interchange fee.

Which UPI payments will attract the interchange fee?

Only certain merchant transactions made by prepaid payment instruments will attract the interchange fee. Wallets, smart cards, vouchers, magnetized chips come under prepaid payment instruments. A few examples of wallets are the Paytm wallet, PhonePe wallet, Amazon Pay, MobiKwik wallet, SODEXO vouchers.

Now suppose, one has money in his/her Paytm or PhonePe wallet and go to a store and scan the QR code and pay it from the wallet. If the transaction amount is above Rs 2,000, an interchange fee of up to 1.1% will be levied.

Who will pay these fees?

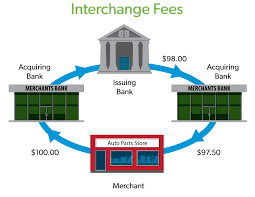

Interchange fees are transaction fees that the merchant has to pay whenever a customer processes a transaction.

Let’s say if one is making a prepaid payment through UPI at a store using a PayTM QR code, the merchant has to pay the interchange fee to the payment service provider, which is PayTM here. Users shall not be liable to pay any interchange fee.

The decision is expected to bring in much-needed revenue for payment service providers, who have been struggling to maintain profitability due to the low-transaction fees on UPI transactions.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com