Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Global Financial Stability Report (GFSR)

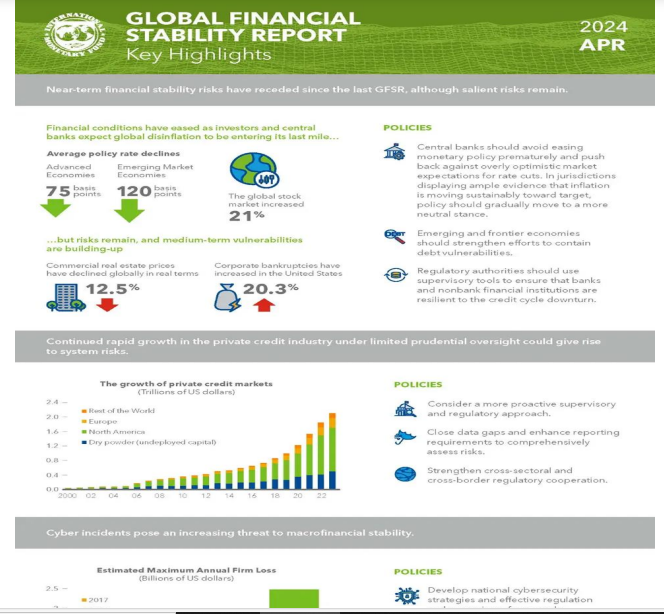

Context: The International Monetary Fund (IMF) has issued its 2024 Global Financial Stability Report, focusing on \'The Last Mile: Financial Vulnerabilities and Risks.\'

Key warnings from the report include:

o Persistent high inflation poses a risk to the global financial system.

o Rising lending in the unregulated credit market is identified as a concern.

o There is a growing threat from increasing cyber-attacks targeting financial institutions.

About:

o The GFSR is a semiannual report issued by the IMF.

o It assesses the stability of global financial markets and the financing environment for emerging markets.

o The report is released twice a year, typically in April and October.

o It focuses on current market conditions and identifies systemic issues that could threaten financial stability.

o The GFSR also examines risks to sustained market access for emerging market borrowers.

o It highlights financial implications of economic imbalances outlined in the IMF\'s World Economic Outlook.

Highlights:

• Inflation Outlook: The IMF warns that investor optimism about slowing inflation and potential interest rate cuts by central banks may be premature. Core inflation has risen in some major economies, and geopolitical risks like conflicts in West Asia and Ukraine could further drive up prices, potentially preventing central banks from lowering interest rates.

• Impact on India\'s Capital Flows: India has been a significant recipient of foreign capital due to expectations of global interest rate cuts. However, if western central banks delay rate cuts, it could prompt investors to withdraw funds from emerging markets like India, leading to currency depreciation and increased pressure

on the financial system.

• Depreciating Rupee: The Indian rupee has been depreciating, reaching a new low against the U.S. dollar. If capital outflows accelerate due to high interest rates in western countries, the Reserve Bank of India (RBI) may intervene by tightening liquidity, potentially slowing down the economy.

• Concerns Over Private Credit Market: The IMF highlights worries about the growing unregulated private credit market, where non-bank financial institutions lend to corporate borrowers. Many borrowers in this market may not be financially stable, with earnings insufficient to cover interest costs.

• Rise of Alternative Investment Funds (AIFs) in India: India has witnessed the expansion of a small private credit market facilitated by Alternative Investment Funds (AIFs), which cater to high-risk borrowers not served by traditional banks. These funds have invested in distressed assets under the Insolvency and Bankruptcy Code (IBC) regime, with investments tripling between 2018-19 and 2022-23.

• Regulatory Scrutiny: Both the RBI and Securities and Exchange Board of India (SEBI) are increasing oversight of AIFs and similar entities in response to the rapid growth of the private credit market, aiming to ensure financial stability and mitigate risks associated with these investments.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com