Ahmedabad

(Head Office)Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Inflation Targeting

News: RBI has been far from achieving its Inflation target of 4%. Despite this, the RBI had recently chosen to pause rate hikes in its latest monetary policy review. There are questions looming whether Inflation Targeting is the right policy mandate for India.

Background:

In this article, we will read about important observations made by the Monetary Policy committee.

What is Inflation Targeting?

Price stability is a necessary precondition for macroeconomic and financial stability. Thus, price stability remains the dominant objective of the monetary policy.

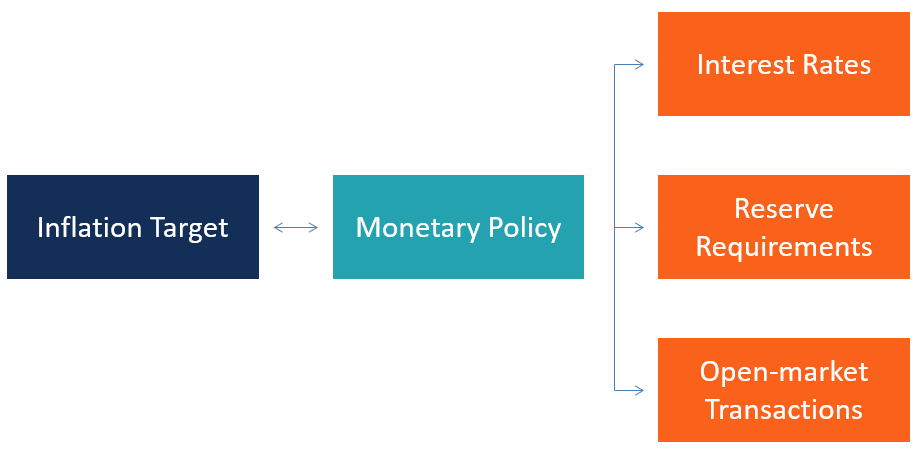

Under Inflation Targeting Framework, the central bank specifies an inflation rate as a goal and adjusts its monetary policy to achieve the specified annual inflation rate. The targeted level of Inflation in India is 4% but the law also provides a comfort zone – 2% to 6% - within which Inflation can stray.

Based on the Urjit Patel committee recommendation (2014), Government of India and RBI also signed the Monetary Policy Framework Agreement in 2015.

The RBI Act, 1934 was amended in 2016 to make inflation targeting the nominal anchor of RBI’s monetary policy and to establish a monetary policy committee (MPC).

What is MPC?

o MPC is a six-member body to set the pocily rate (repo rate) to achieve the inflation target while keeping in mind growth objectives.

o Composition - 3 internal members of RBI (including RBI Governer as chairman) and 3 external members appointed by government.

o The MPC is required to meet at least 4 times in a year.

o Quorum - At least 4 members need to be present for the meeting.

o Decision maling - One vote of each member with RBI Governar having a second or casting vote in case of equality of votes.

Some important observations made by Professor Ashima Goyal (She had advocated against rate hike in February 2023 MPC itself):

She said the baton was now in hands of government (via fiscal policy) to help bring down inflation. she felt under the circumstances — as in, when inflation is pushed up by supply bottlenecks and costs instead of being pulled up by demand — monetary measures were not enough to contain inflation and needed fiscal (relating to government’s taxes and spending) action.

She warned against raising interest rates because they not only hurt growth but also be counterproductive from the perspective of containing inflation.

Raising real policy rates [that’s nominal interest rates minus inflation] to reduce demand has a stronger effect on growth than it does on inflation.

Since there are more lags in monetary transmission in India, over-shooting can have persistent deleterious effects here, including instability.

Macroeconomic stability improves most rapidly if real interest rates are kept smoothly below growth rates and counter external shocks. The Indian economy is well-poised to achieve this combination and to reduce its chronic underemployment.

Why is there a need for an alternative model in India?

Contrary to the notion of an overheating economy, which experiences inflation because demand outstrips supply, in India’s case (Since 2019) it is the supply costs and bottlenecks that have created inflation, not an economy running hot.

In India, inflation is often driven by supply-shocks originating and operating through the food economy. Two, merely raising interest rates doesn’t help beyond a point; indeed, it is counter-productive.

Many economists, such as Pulapre Balakrishnan of Ashoka University, have repeatedly warned against the use of inflation-targeting by the RBI. Instead, he pointed to another way of viewing inflation and inflation control. This is called the “structuralist model”. It basically says the same – Focus on supply side constraints when that is driving inflation.

Address : 506, 3rd EYE THREE (III), Opp. Induben Khakhrawala, Girish Cold Drink Cross Road, CG Road, Navrangpura, Ahmedabad, 380009.

Mobile : 8469231587 / 9586028957

Telephone : 079-40098991

E-mail: dics.upsc@gmail.com

Address: A-306, The Landmark, Urjanagar-1, Opp. Spicy Street, Kudasan – Por Road, Kudasan, Gandhinagar – 382421

Mobile : 9723832444 / 9723932444

E-mail: dics.gnagar@gmail.com

Address: 2nd Floor, 9 Shivali Society, L&T Circle, opp. Ratri Bazar, Karelibaugh, Vadodara, 390018

Mobile : 9725692037 / 9725692054

E-mail: dics.vadodara@gmail.com

Address: 403, Raj Victoria, Opp. Pal Walkway, Near Galaxy Circle, Pal, Surat-394510

Mobile : 8401031583 / 8401031587

E-mail: dics.surat@gmail.com

Address: 303,305 K 158 Complex Above Magson, Sindhubhavan Road Ahmedabad-380059

Mobile : 9974751177 / 8469231587

E-mail: dicssbr@gmail.com

Address: 57/17, 2nd Floor, Old Rajinder Nagar Market, Bada Bazaar Marg, Delhi-60

Mobile : 9104830862 / 9104830865

E-mail: dics.newdelhi@gmail.com